B2B DEFI PAYMENTS PRODUCT

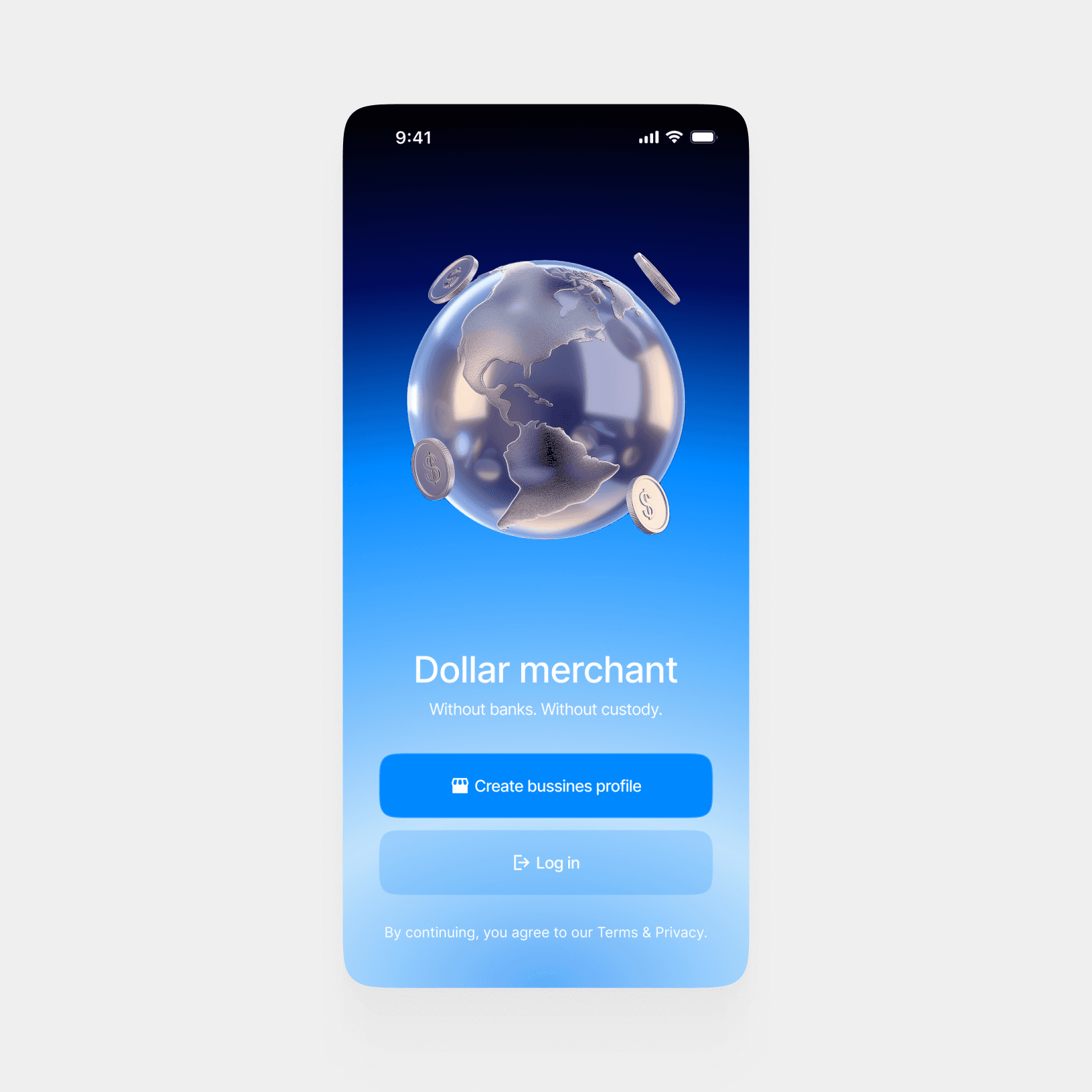

Dollar merchant

Dollar Merchant is a B2B application that allows businesses to accept payments in digital dollars via QR codes. The product was designed as part of the NDA ecosystem, but is publicly presented under an NDA name. My role focused on designing the merchant-facing side of the product — from business onboarding to POS mode and receiving payments from end users. The core goal was to remove crypto complexity and make DeFi payments understandable for offline businesses with no prior crypto experience.

B2B DEFI PAYMENTS PRODUCT

Dollar merchant

Dollar Merchant is a B2B application that allows businesses to accept payments in digital dollars via QR codes. The product was designed as part of the NDA ecosystem, but is publicly presented under an NDA name. My role focused on designing the merchant-facing side of the product — from business onboarding to POS mode and receiving payments from end users. The core goal was to remove crypto complexity and make DeFi payments understandable for offline businesses with no prior crypto experience.

B2B DEFI PAYMENTS PRODUCT

Dollar merchant

Dollar Merchant is a B2B application that allows businesses to accept payments in digital dollars via QR codes. The product was designed as part of the NDA ecosystem, but is publicly presented under an NDA name. My role focused on designing the merchant-facing side of the product — from business onboarding to POS mode and receiving payments from end users. The core goal was to remove crypto complexity and make DeFi payments understandable for offline businesses with no prior crypto experience.

Problem

Most payment solutions for businesses rely on traditional banking acquiring or fail to work properly in cross-border scenarios. In many regions, businesses face high fees, delayed settlements, chargebacks, and the risk of account freezes.

At the same time, stablecoins are already used as a medium of exchange, but existing crypto payment tools are not suitable for mass adoption. They are complex, unintuitive, and fail to establish trust with consumers.

The key problem is the lack of a simple, trusted interface between businesses and customers in a non-custodial environment.

Most payment solutions for businesses rely on traditional banking acquiring or fail to work properly in cross-border scenarios. In many regions, businesses face high fees, delayed settlements, chargebacks, and the risk of account freezes.

At the same time, stablecoins are already used as a medium of exchange, but existing crypto payment tools are not suitable for mass adoption. They are complex, unintuitive, and fail to establish trust with consumers.

The key problem is the lack of a simple, trusted interface between businesses and customers in a non-custodial environment.

Most payment solutions for businesses rely on traditional banking acquiring or fail to work properly in cross-border scenarios. In many regions, businesses face high fees, delayed settlements, chargebacks, and the risk of account freezes.

At the same time, stablecoins are already used as a medium of exchange, but existing crypto payment tools are not suitable for mass adoption. They are complex, unintuitive, and fail to establish trust with consumers.

The key problem is the lack of a simple, trusted interface between businesses and customers in a non-custodial environment.

Goals

The goal was to design a merchant product that enables businesses to accept digital dollar payments as easily as with a traditional POS terminal — without banks, custody, or intermediaries.

The product needed to work on mobile devices and POS-style terminals, support QR payments, and provide customers with a clear understanding of who they are paying.

The goal was to design a merchant product that enables businesses to accept digital dollar payments as easily as with a traditional POS terminal — without banks, custody, or intermediaries.

The product needed to work on mobile devices and POS-style terminals, support QR payments, and provide customers with a clear understanding of who they are paying.

The goal was to design a merchant product that enables businesses to accept digital dollar payments as easily as with a traditional POS terminal — without banks, custody, or intermediaries.

The product needed to work on mobile devices and POS-style terminals, support QR payments, and provide customers with a clear understanding of who they are paying.

Role

I worked as the product designer and I was responsible for:

Product concept and positioning of Dollar Merchant

UX architecture for business onboarding

POS and invoice flows

Consumer payment preview and confirmation logic

Copywriting and tone of voice

Visual system and UI consistency

I worked as the product designer and I was responsible for:

Product concept and positioning of Dollar Merchant

UX architecture for business onboarding

POS and invoice flows

Consumer payment preview and confirmation logic

Copywriting and tone of voice

Visual system and UI consistency

I worked as the product designer and I was responsible for:

Product concept and positioning of Dollar Merchant

UX architecture for business onboarding

POS and invoice flows

Consumer payment preview and confirmation logic

Copywriting and tone of voice

Visual system and UI consistency

Key decisions

One of the core product decisions was introducing an on-chain business identity.

Instead of a traditional server-side profile, businesses create an identity consisting of a name and logo that is used in every payment flow. When a customer scans a QR code, they see not just a wallet address, but a recognizable business name and visual identity.

This decision solves several problems at once:

Builds trust in QR-based payments

Reduces phishing and QR substitution risks

Works without custody or platform-level verification

Importantly, NFT terminology is intentionally hidden from users — the system is explained in simple, non-crypto language.

One of the core product decisions was introducing an on-chain business identity.

Instead of a traditional server-side profile, businesses create an identity consisting of a name and logo that is used in every payment flow. When a customer scans a QR code, they see not just a wallet address, but a recognizable business name and visual identity.

This decision solves several problems at once:

Builds trust in QR-based payments

Reduces phishing and QR substitution risks

Works without custody or platform-level verification

Importantly, NFT terminology is intentionally hidden from users — the system is explained in simple, non-crypto language.

One of the core product decisions was introducing an on-chain business identity.

Instead of a traditional server-side profile, businesses create an identity consisting of a name and logo that is used in every payment flow. When a customer scans a QR code, they see not just a wallet address, but a recognizable business name and visual identity.

This decision solves several problems at once:

Builds trust in QR-based payments

Reduces phishing and QR substitution risks

Works without custody or platform-level verification

Importantly, NFT terminology is intentionally hidden from users — the system is explained in simple, non-crypto language.

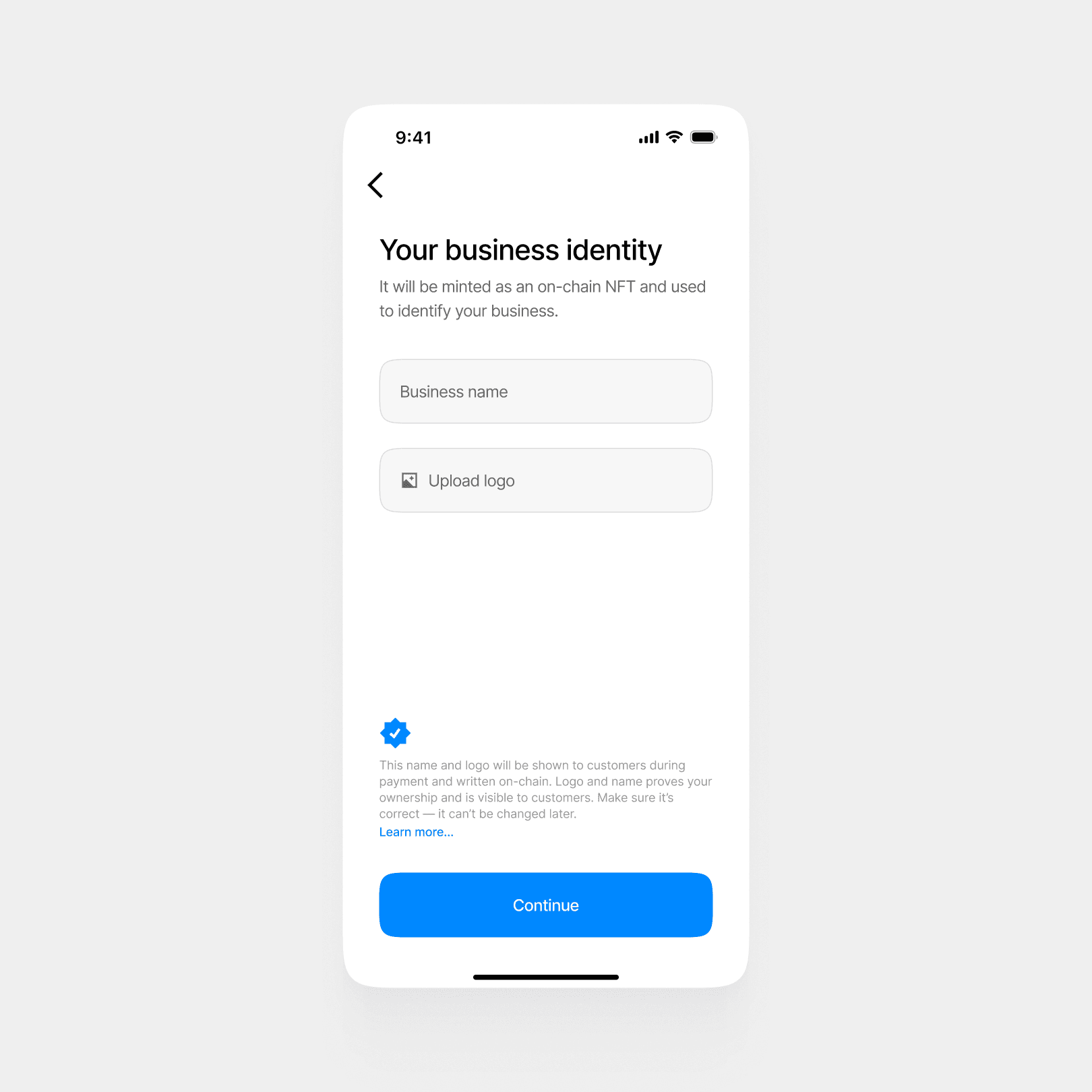

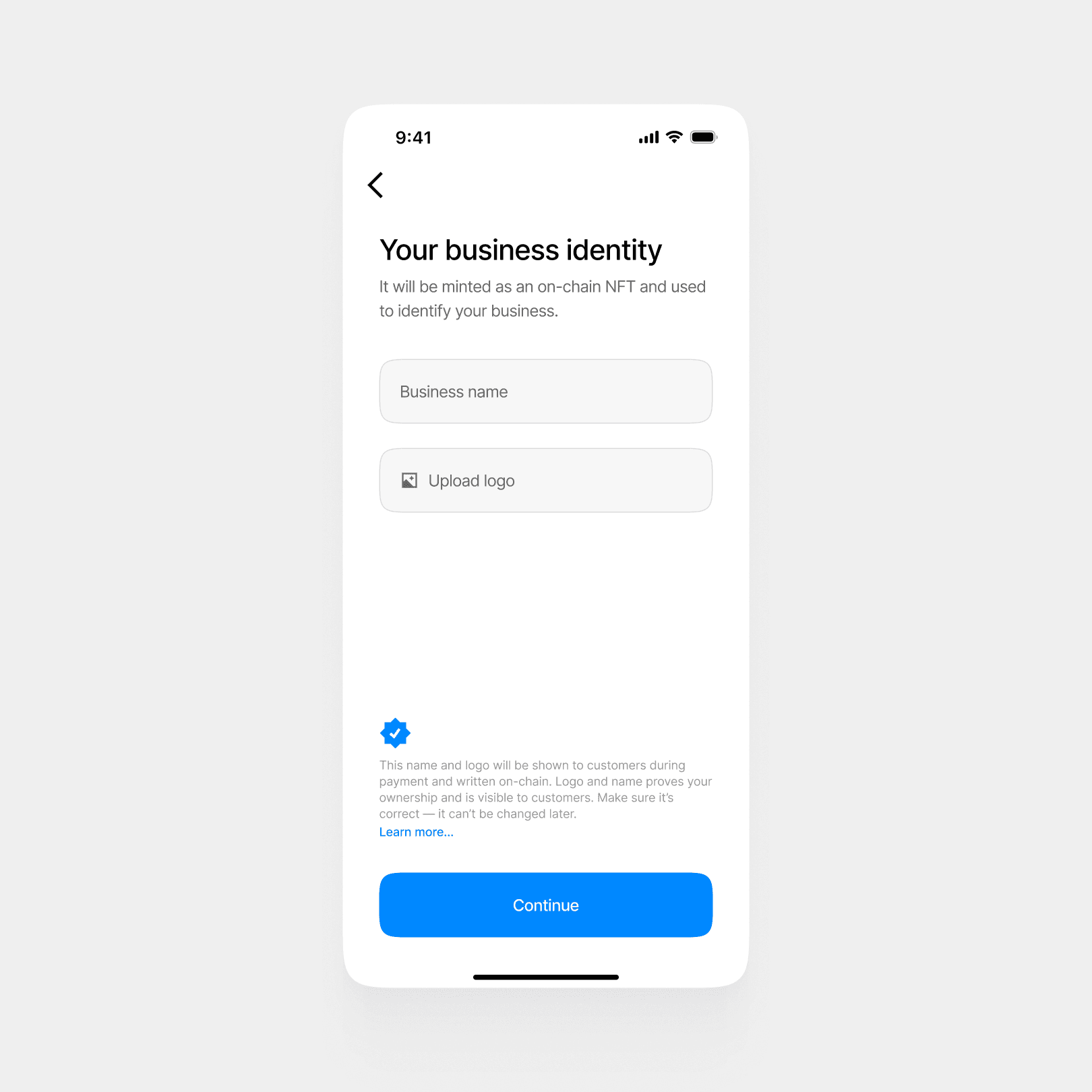

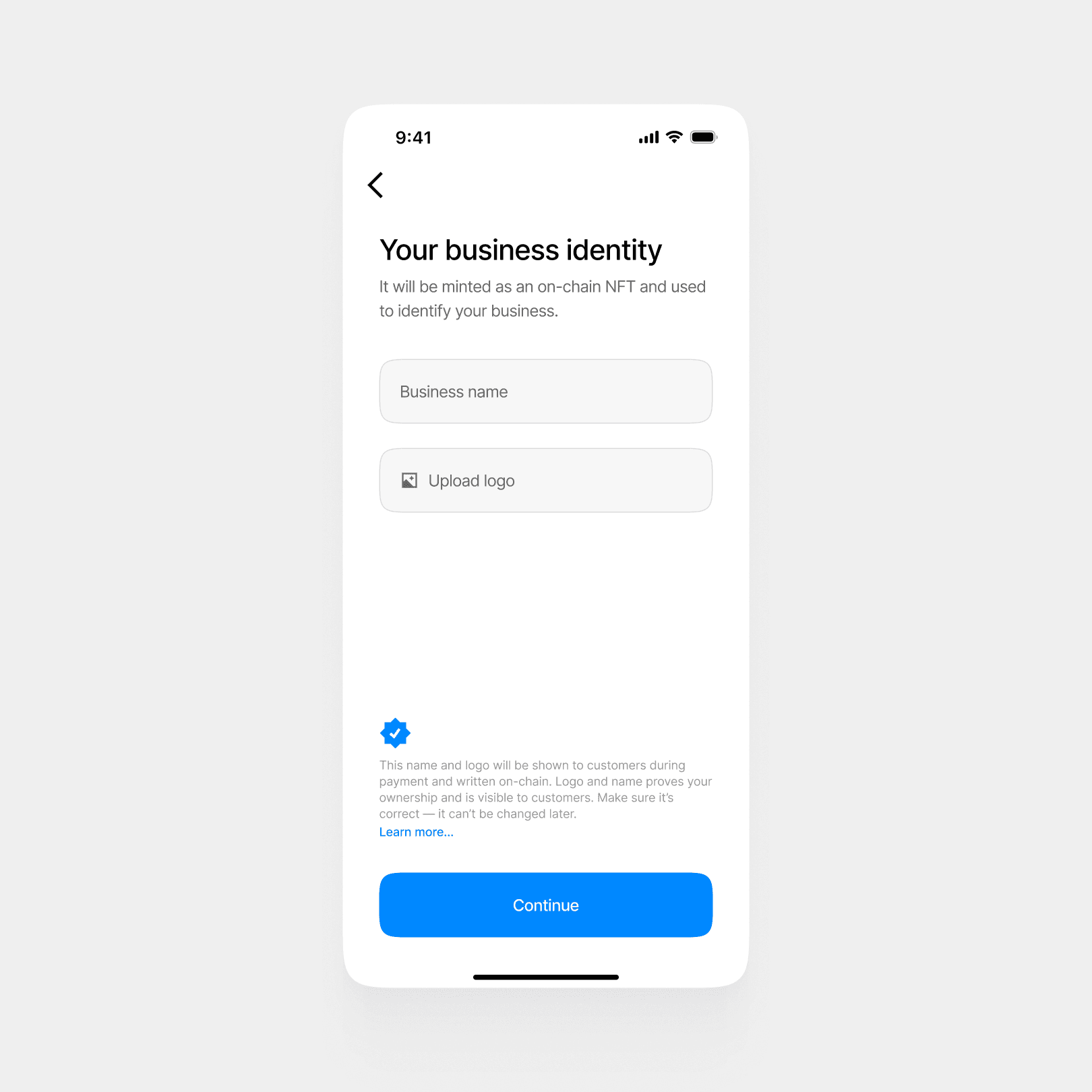

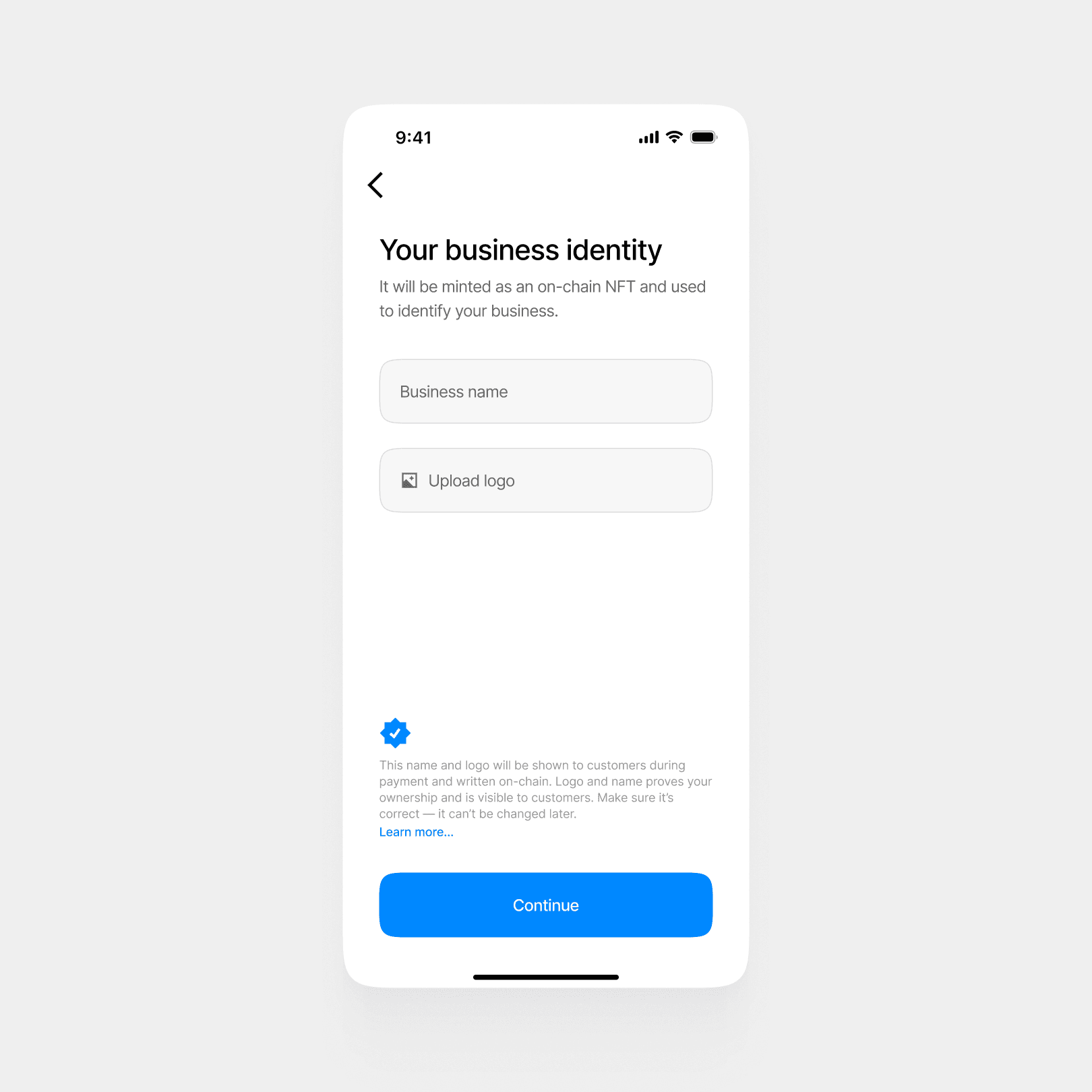

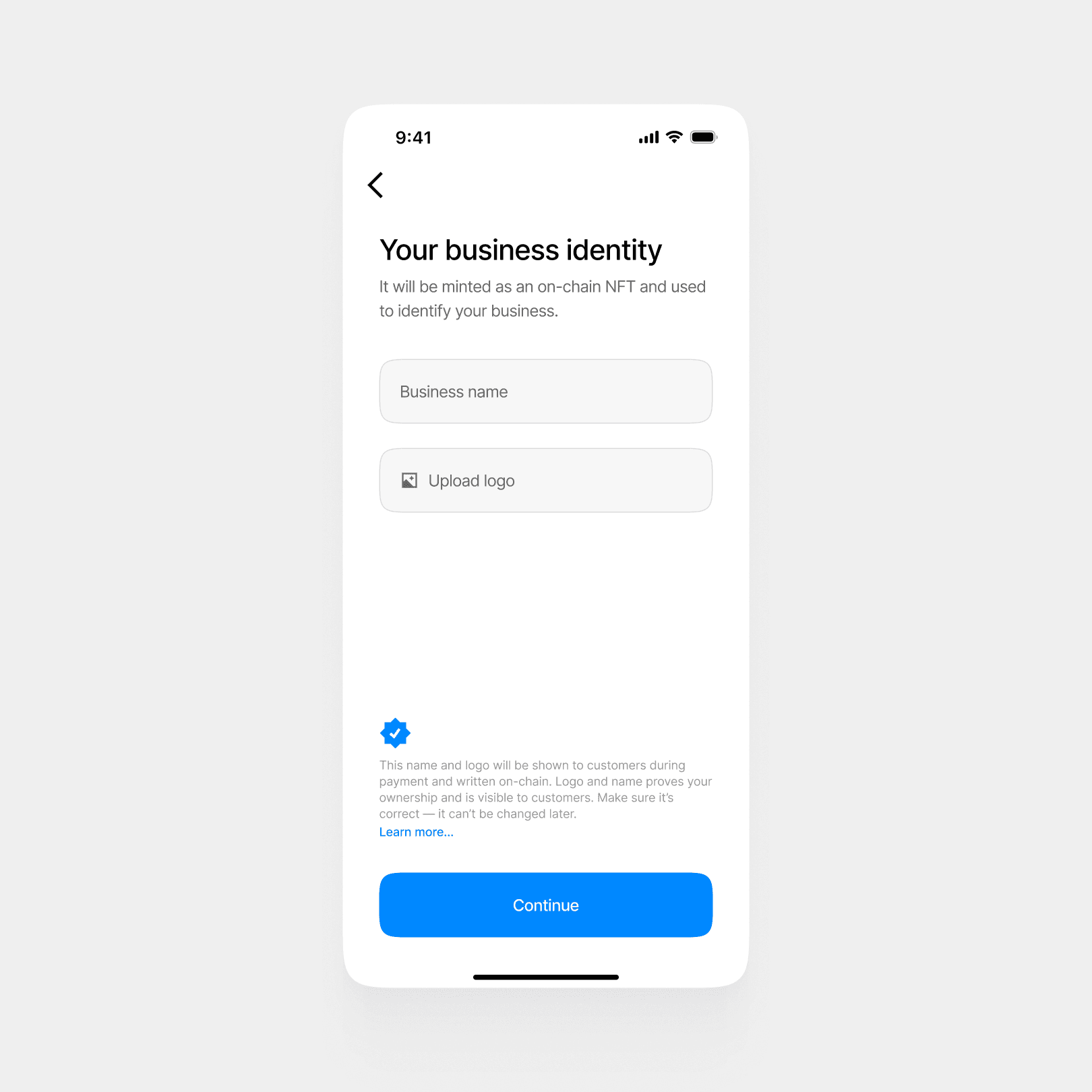

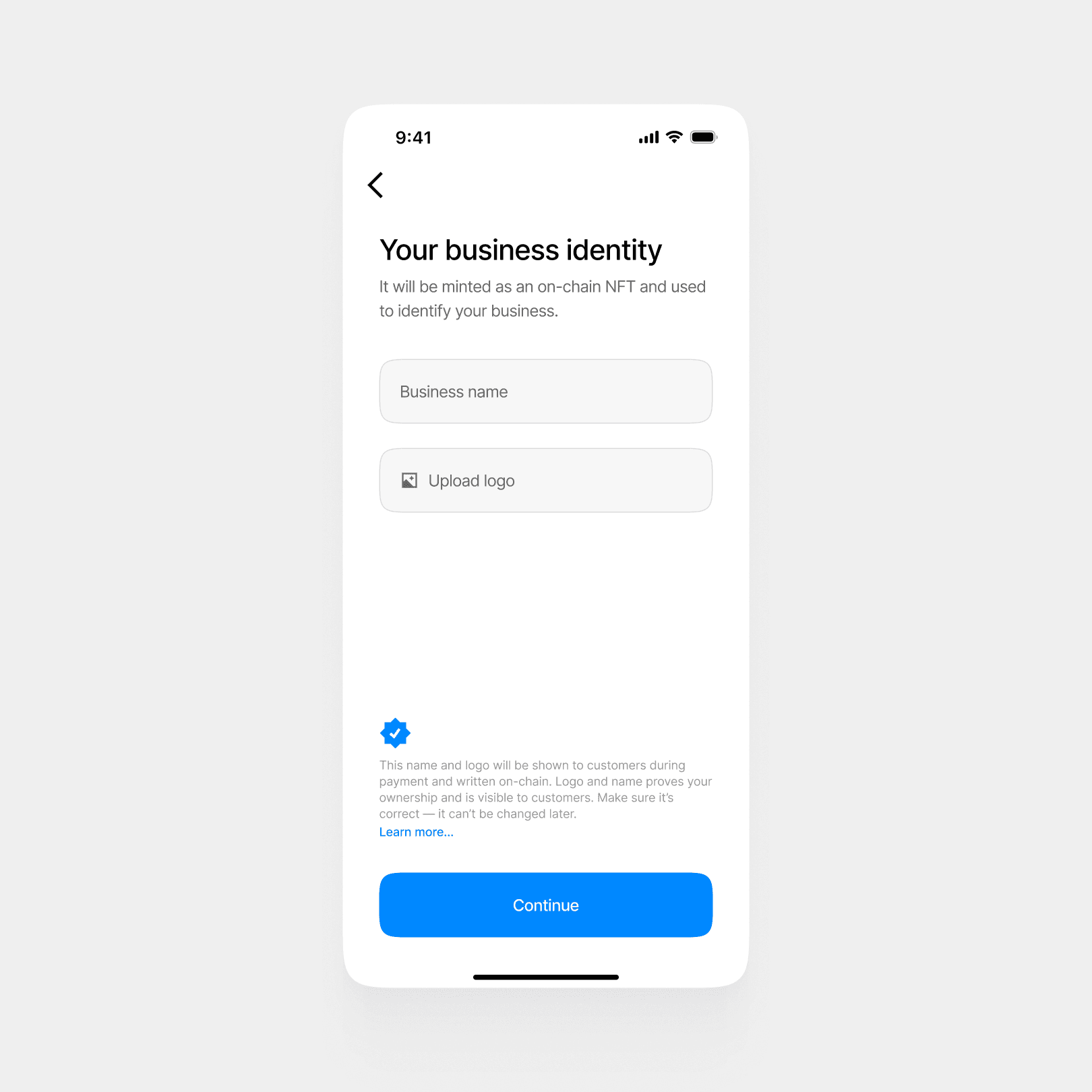

Onboarding

Merchant onboarding was designed as a single, clear flow without crypto jargon or unnecessary steps.

The business enters its name, uploads a logo, and is shown a review screen to preview how customers will see the business during payment. This reduces errors and gives merchants confidence and control.

The identity creation step is presented as a secure and irreversible action, without explicit blockchain terminology, but with a clear explanation that the data becomes publicly verifiable.

Merchant onboarding was designed as a single, clear flow without crypto jargon or unnecessary steps.

The business enters its name, uploads a logo, and is shown a review screen to preview how customers will see the business during payment. This reduces errors and gives merchants confidence and control.

The identity creation step is presented as a secure and irreversible action, without explicit blockchain terminology, but with a clear explanation that the data becomes publicly verifiable.

Merchant onboarding was designed as a single, clear flow without crypto jargon or unnecessary steps.

The business enters its name, uploads a logo, and is shown a review screen to preview how customers will see the business during payment. This reduces errors and gives merchants confidence and control.

The identity creation step is presented as a secure and irreversible action, without explicit blockchain terminology, but with a clear explanation that the data becomes publicly verifiable.

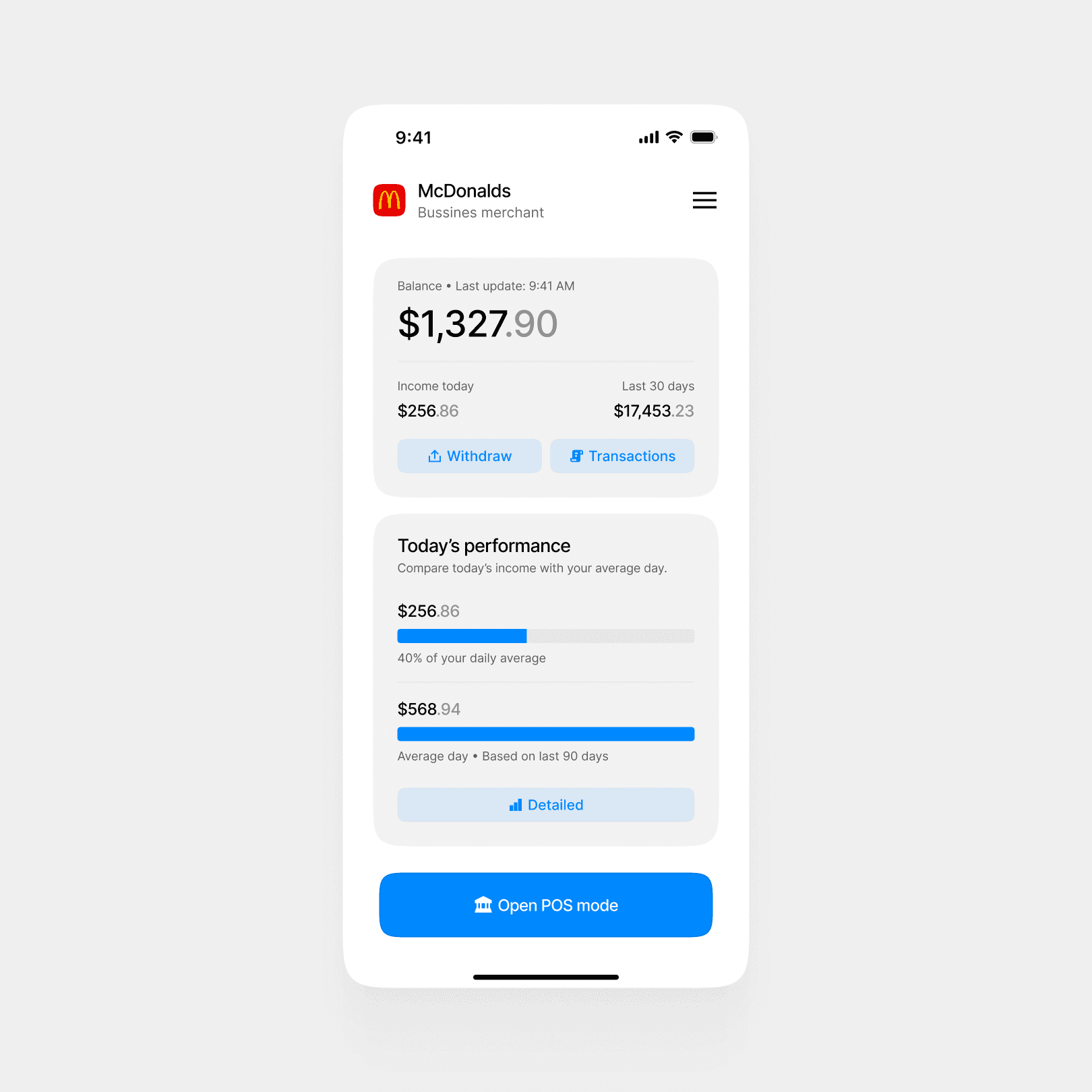

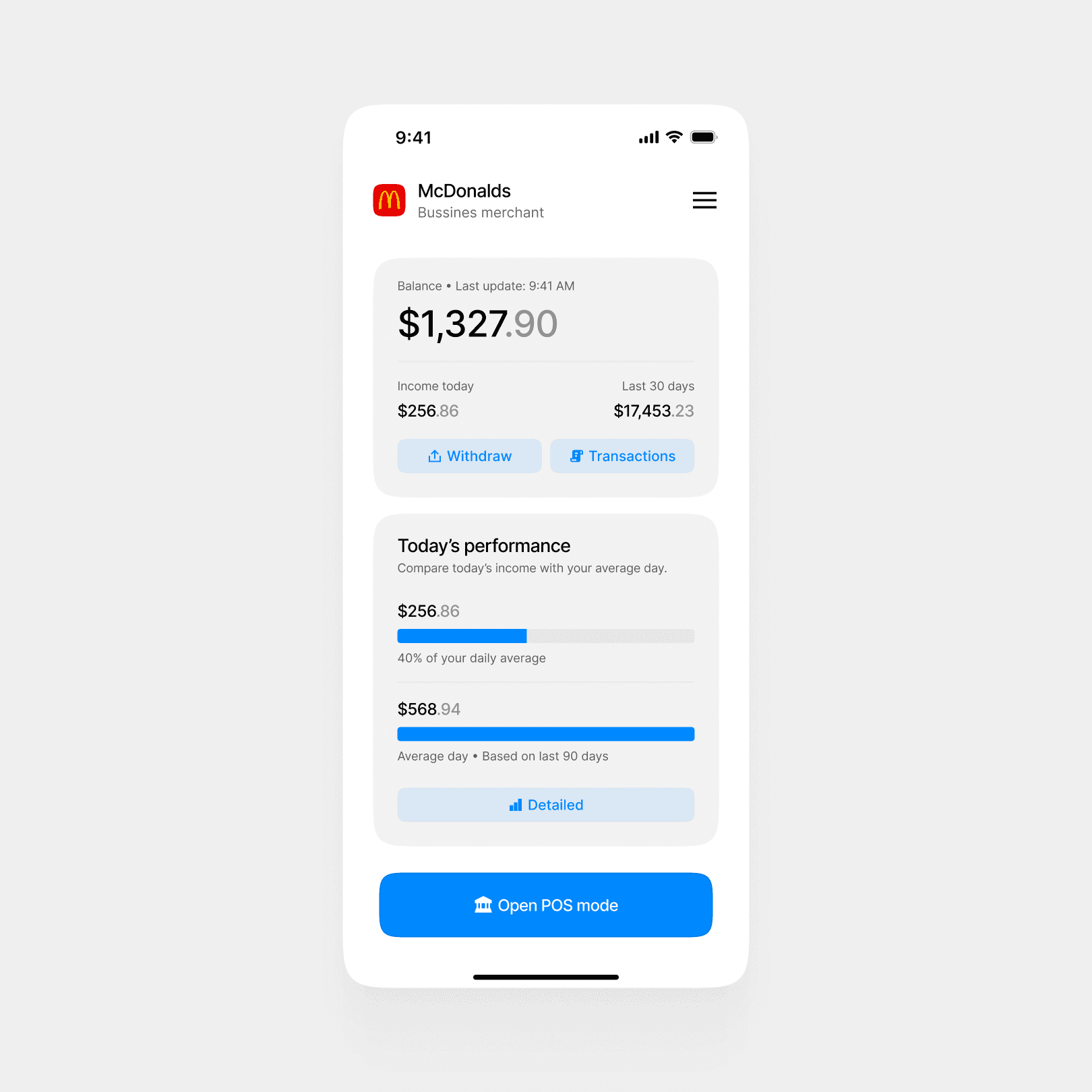

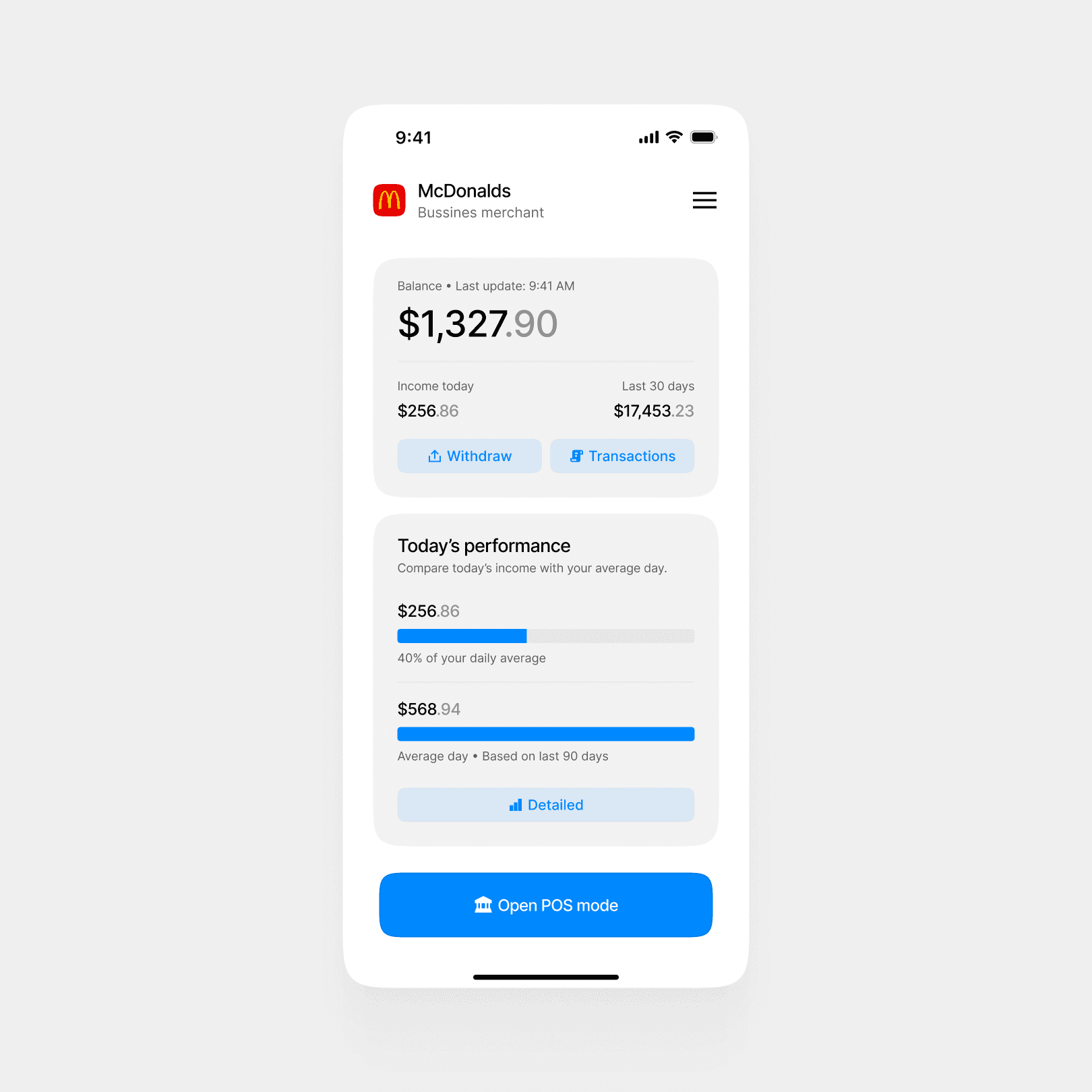

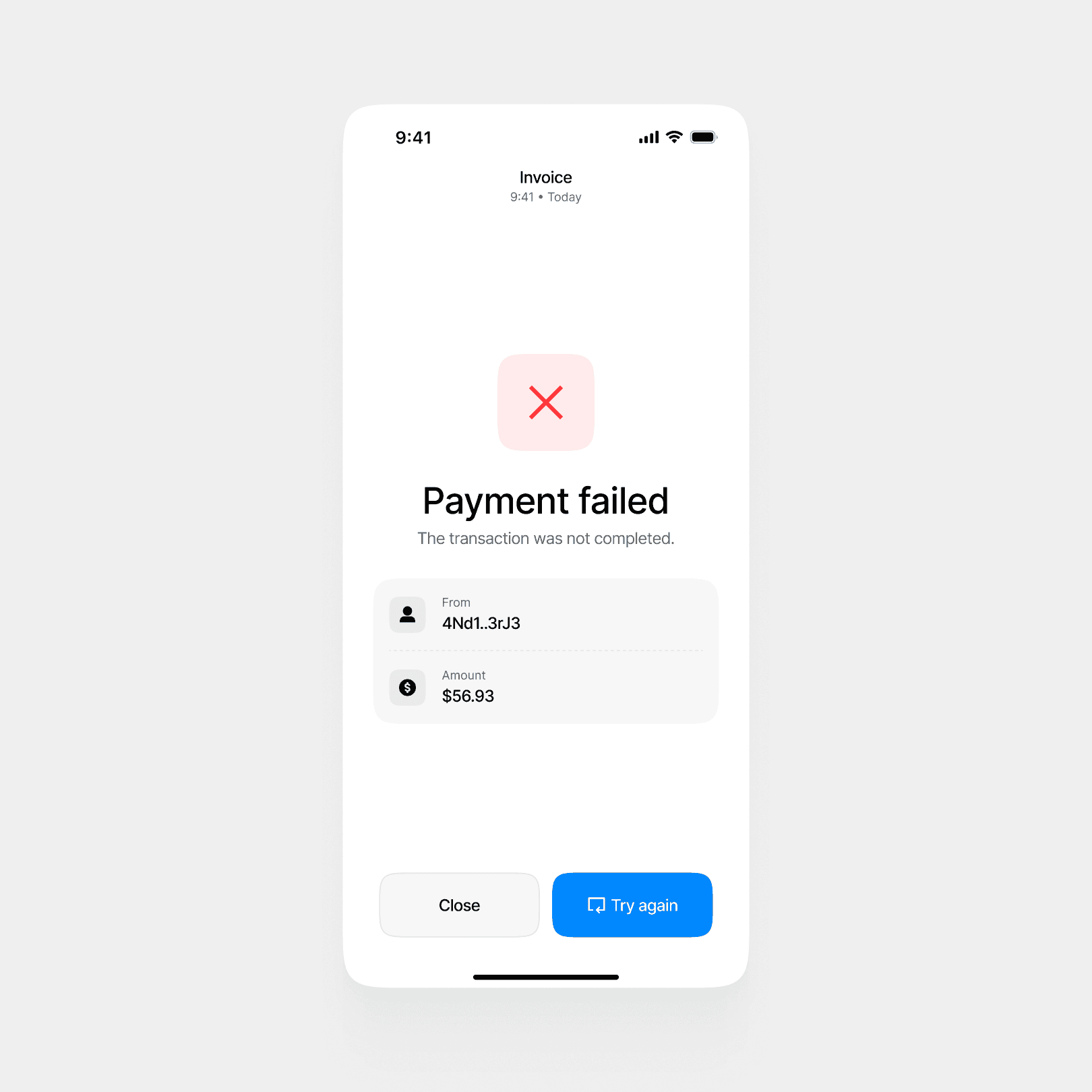

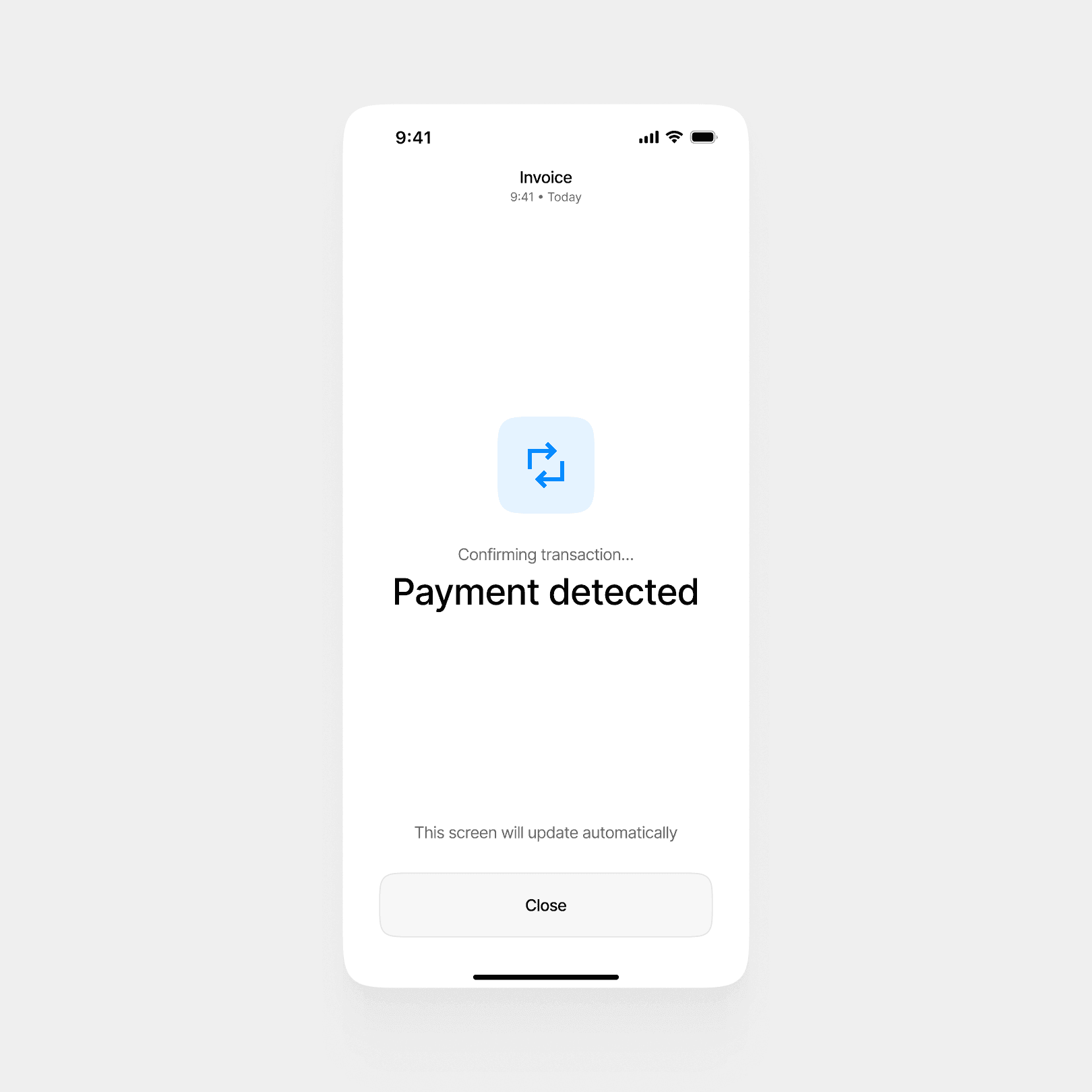

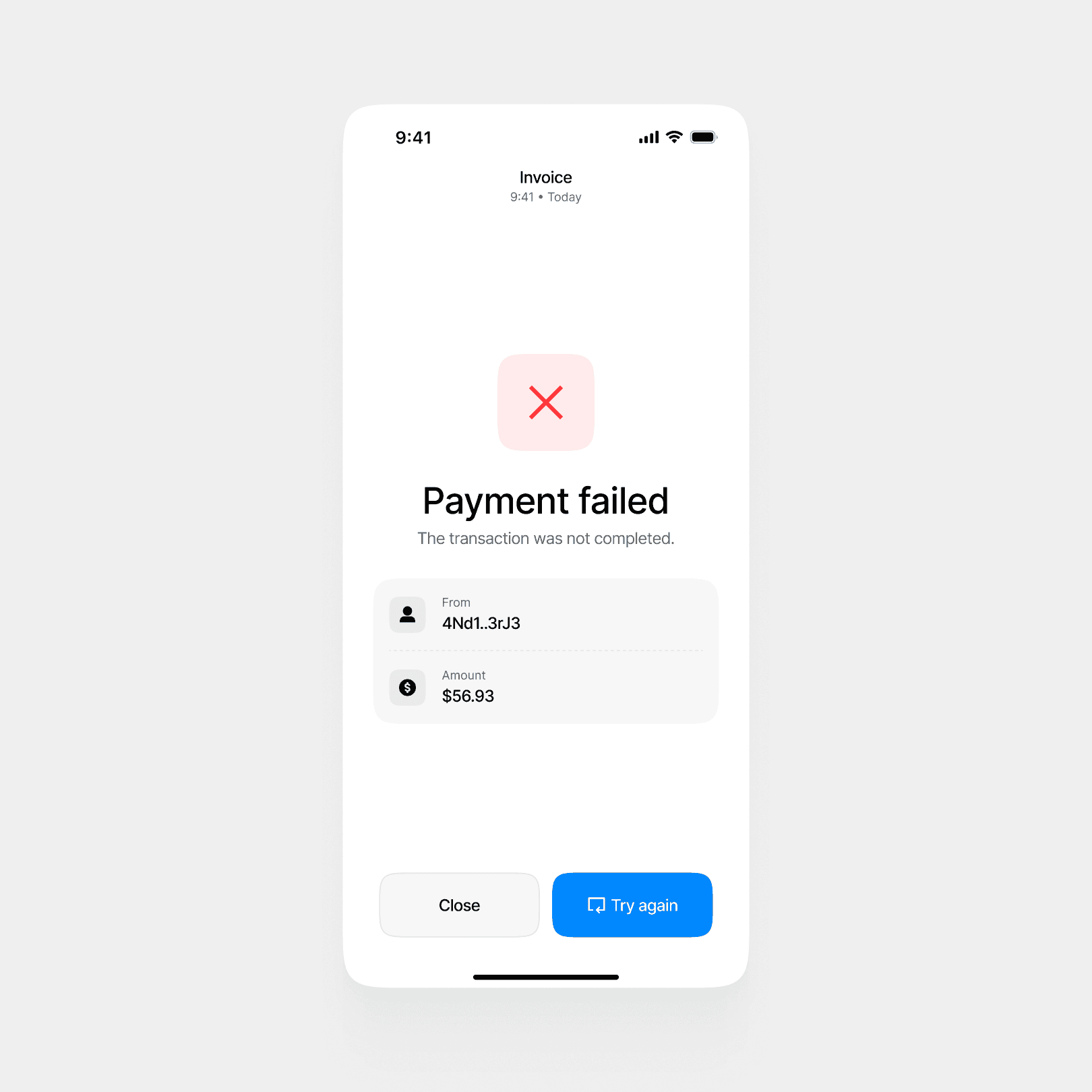

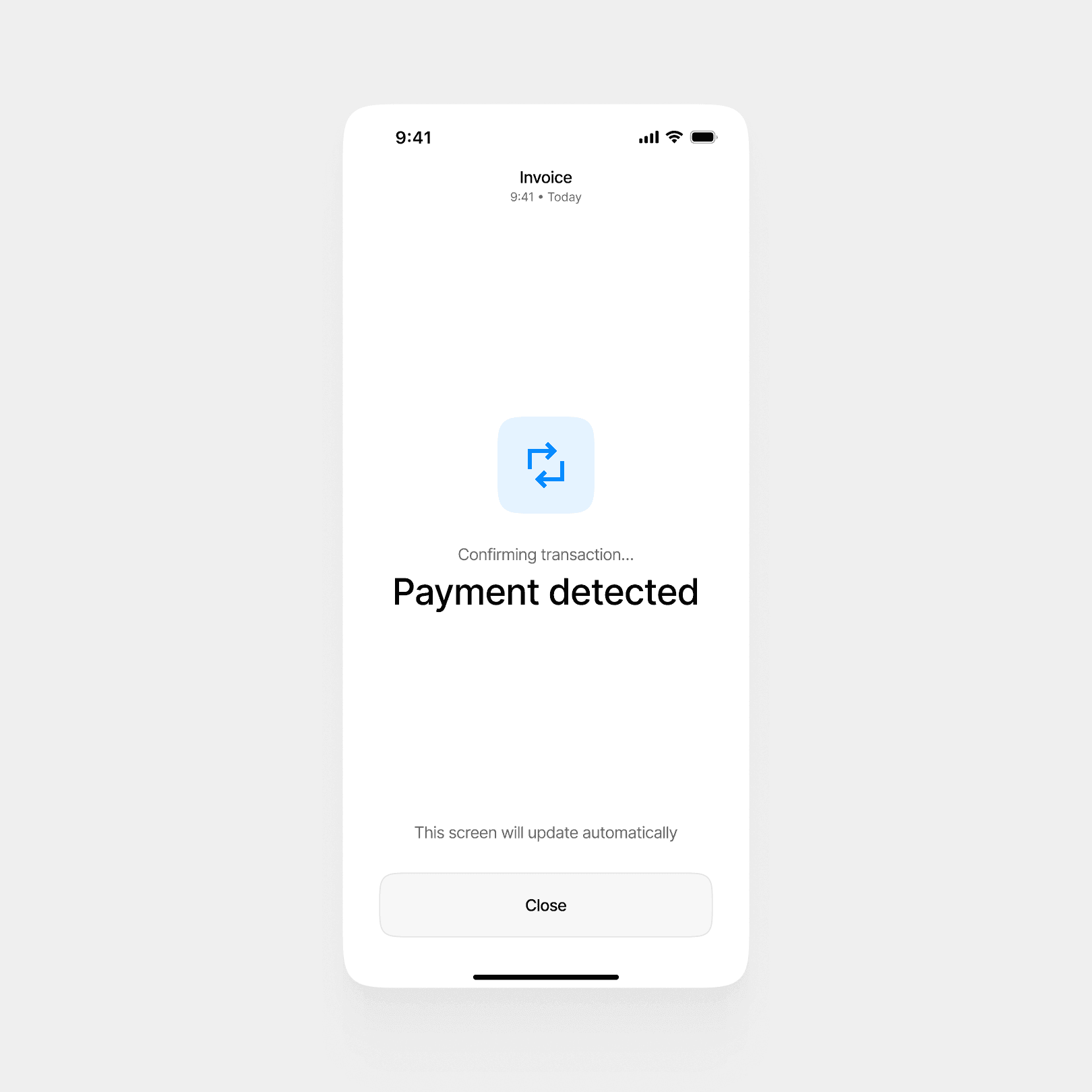

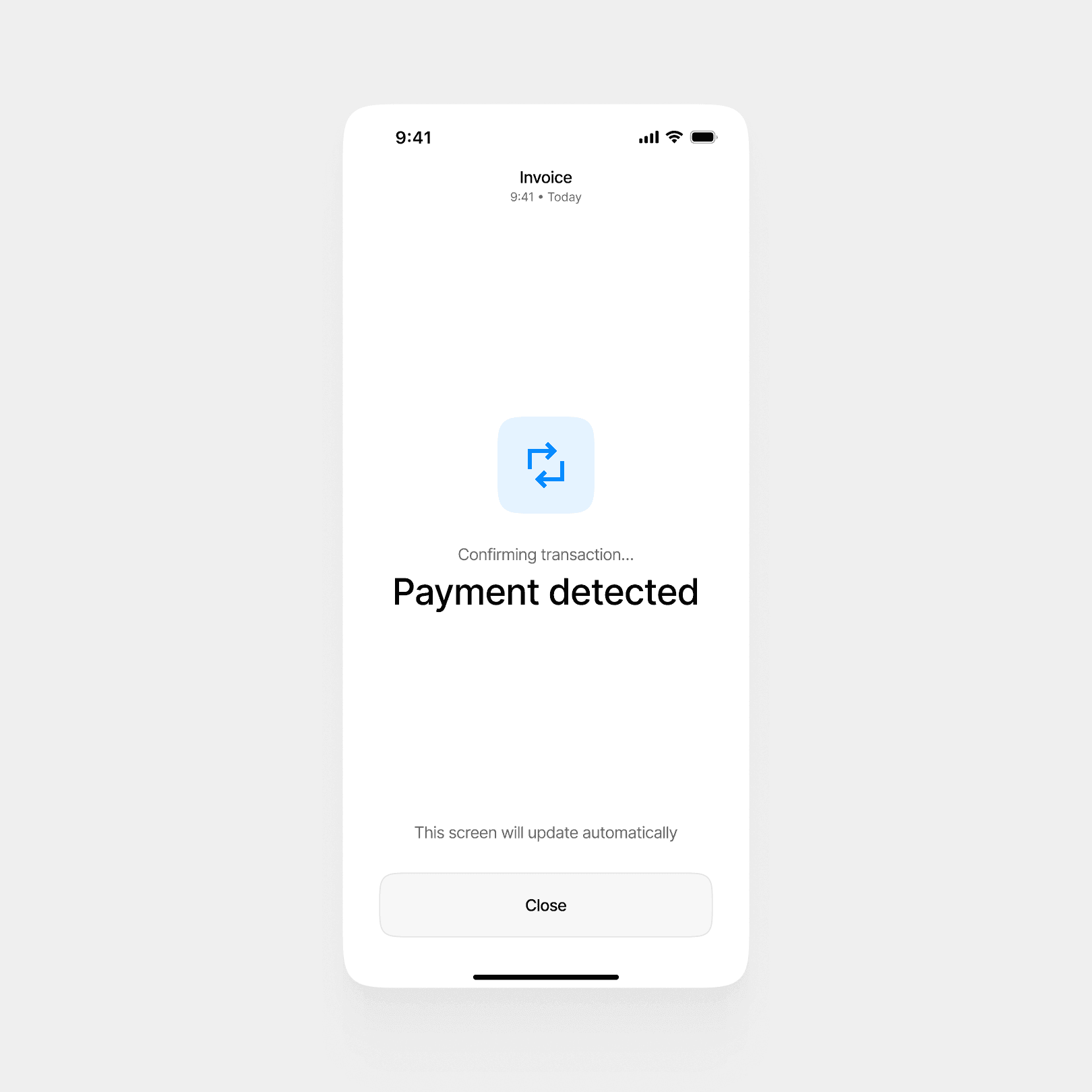

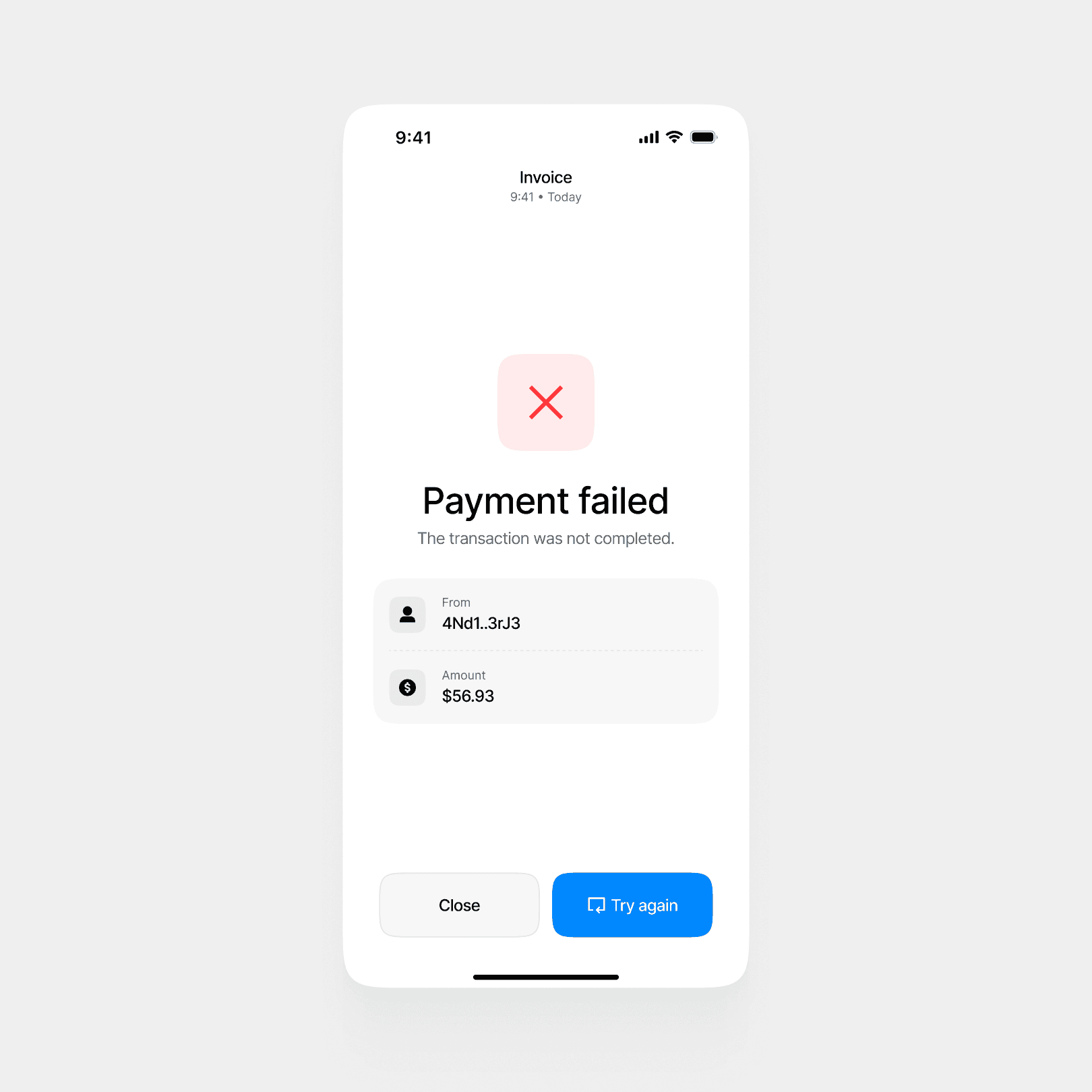

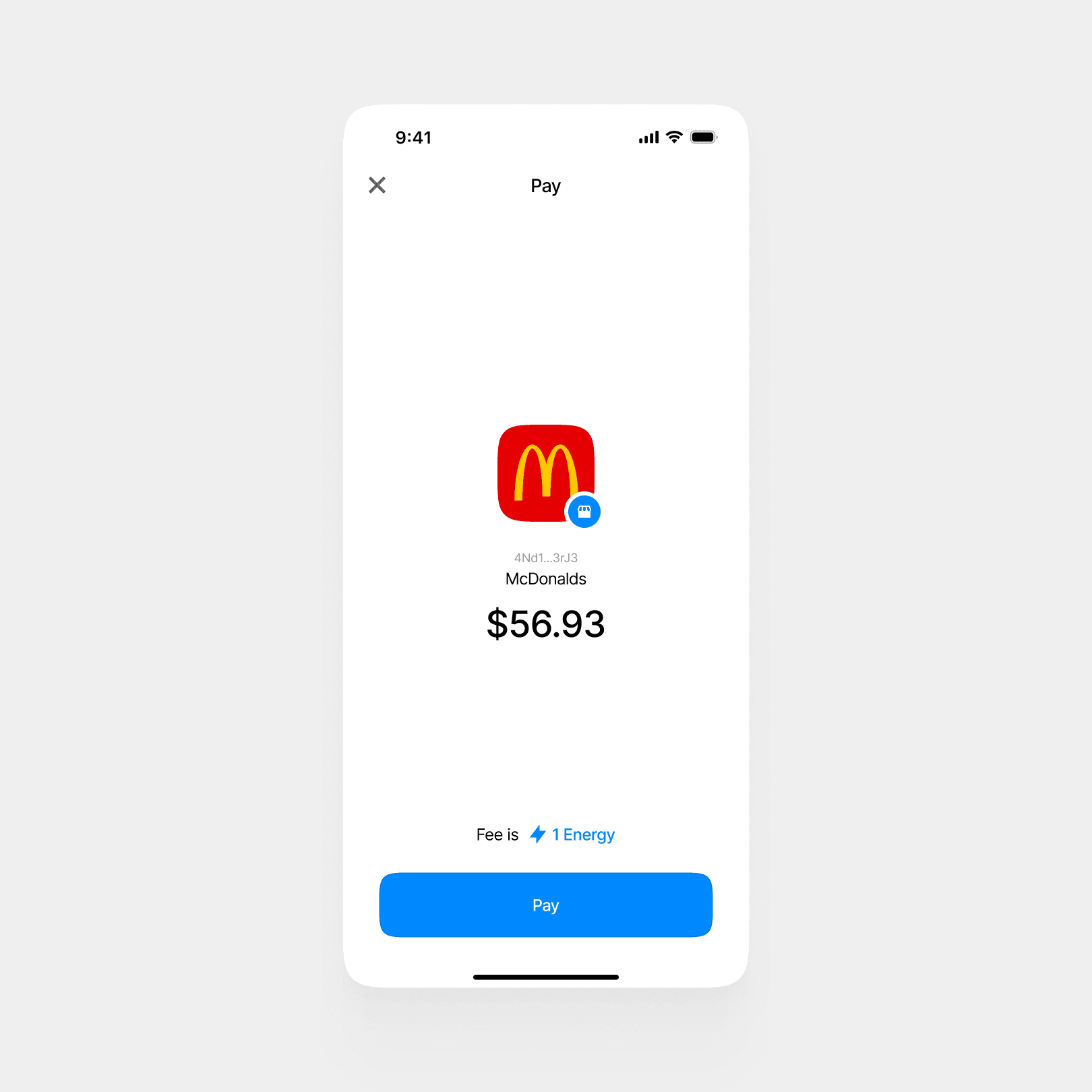

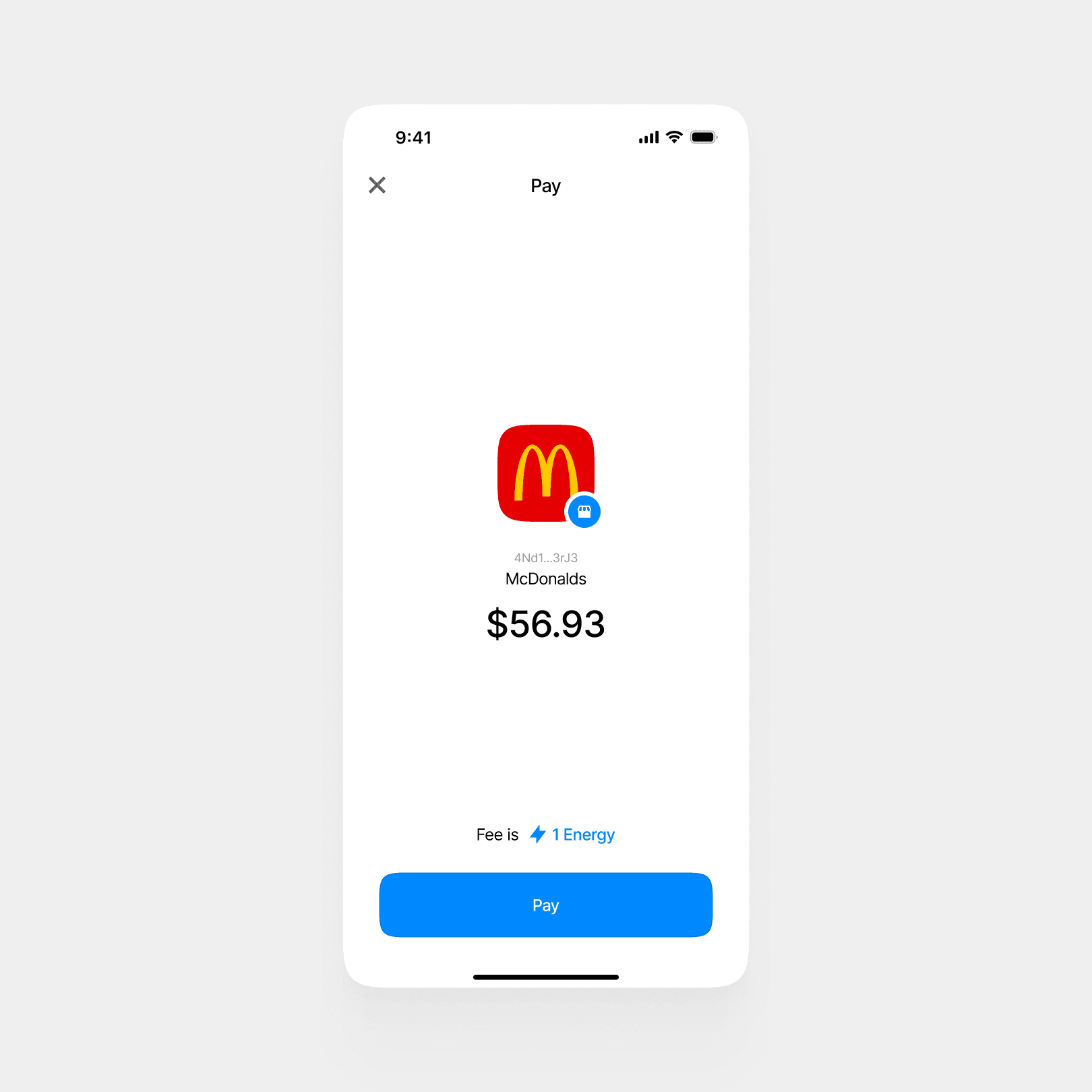

POS & Payments flow

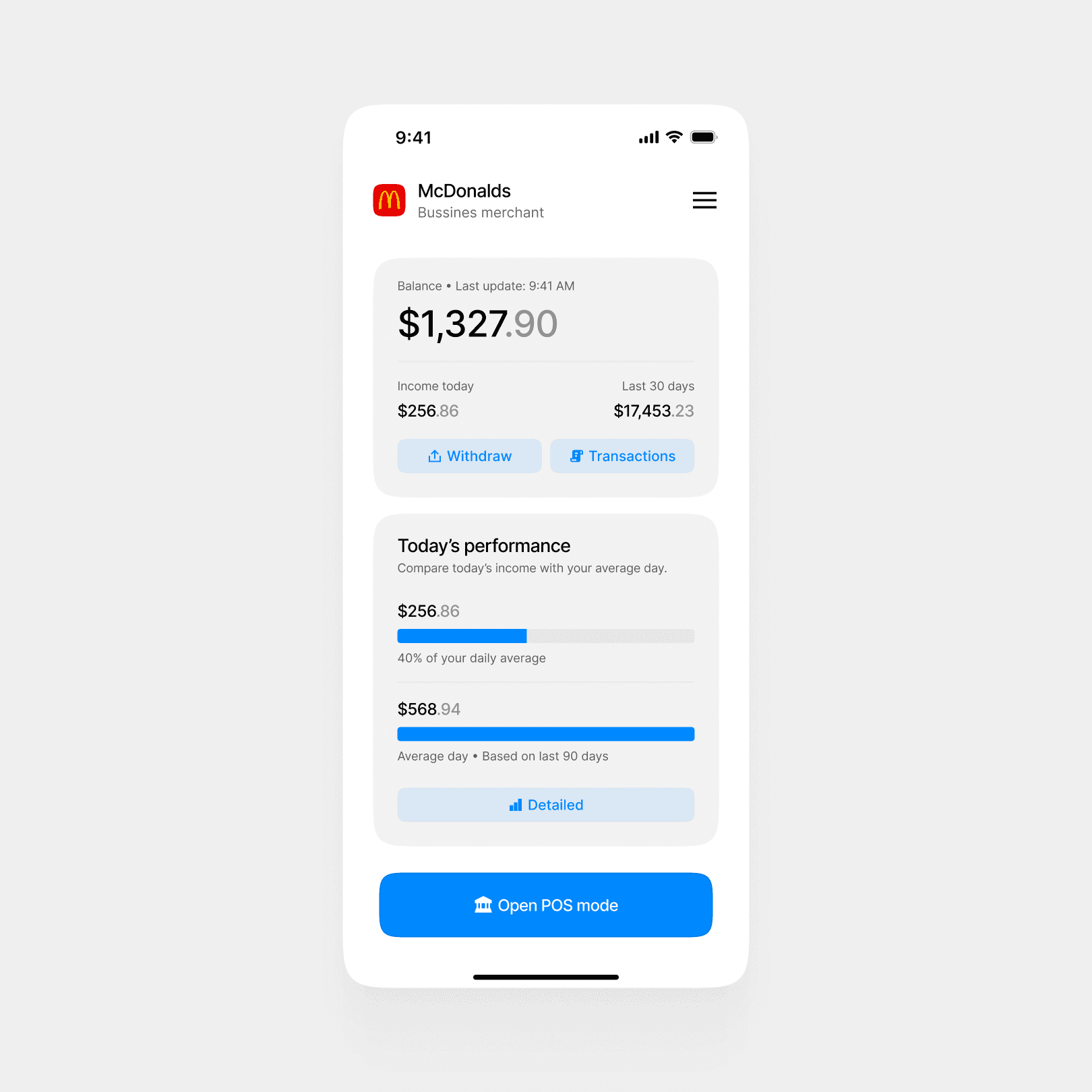

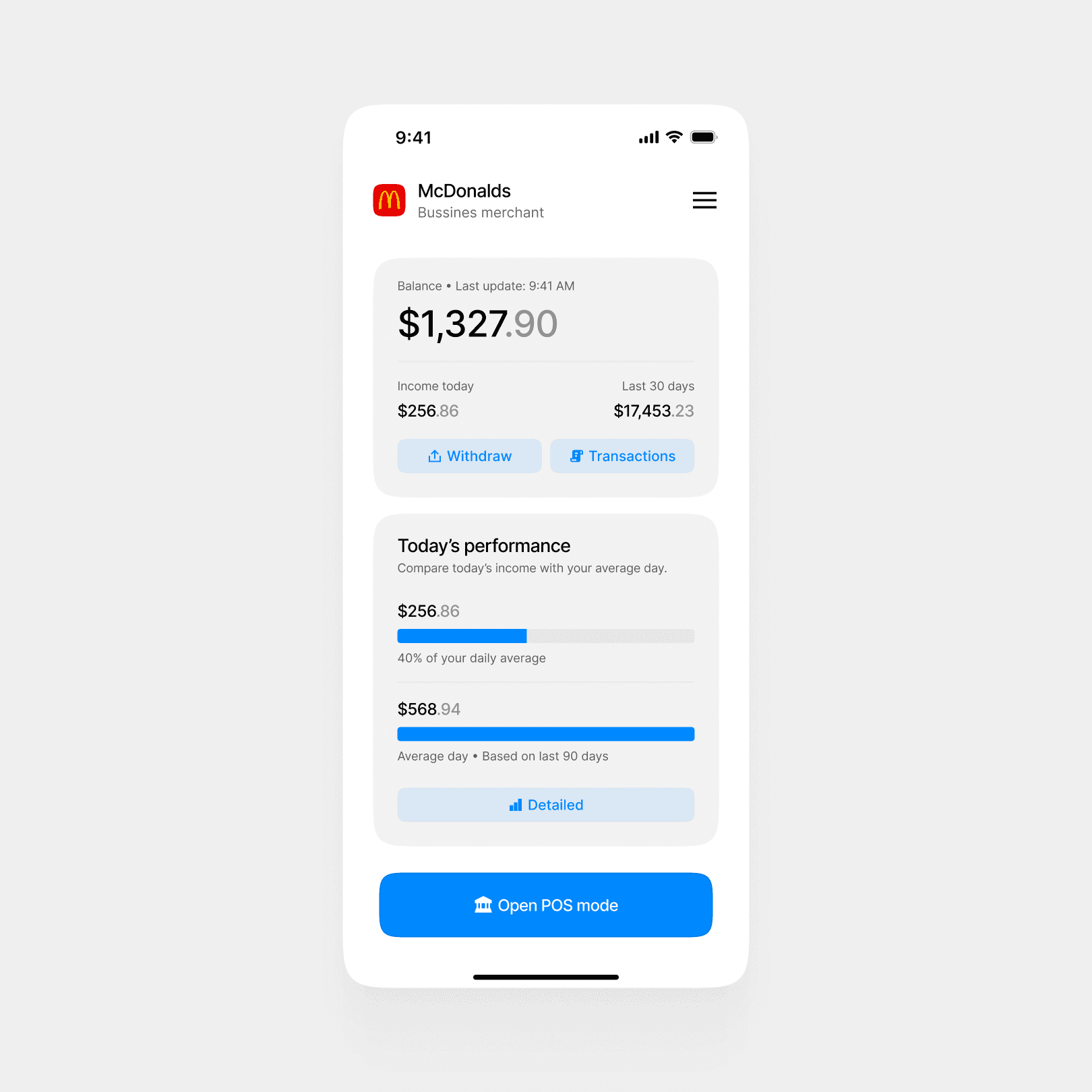

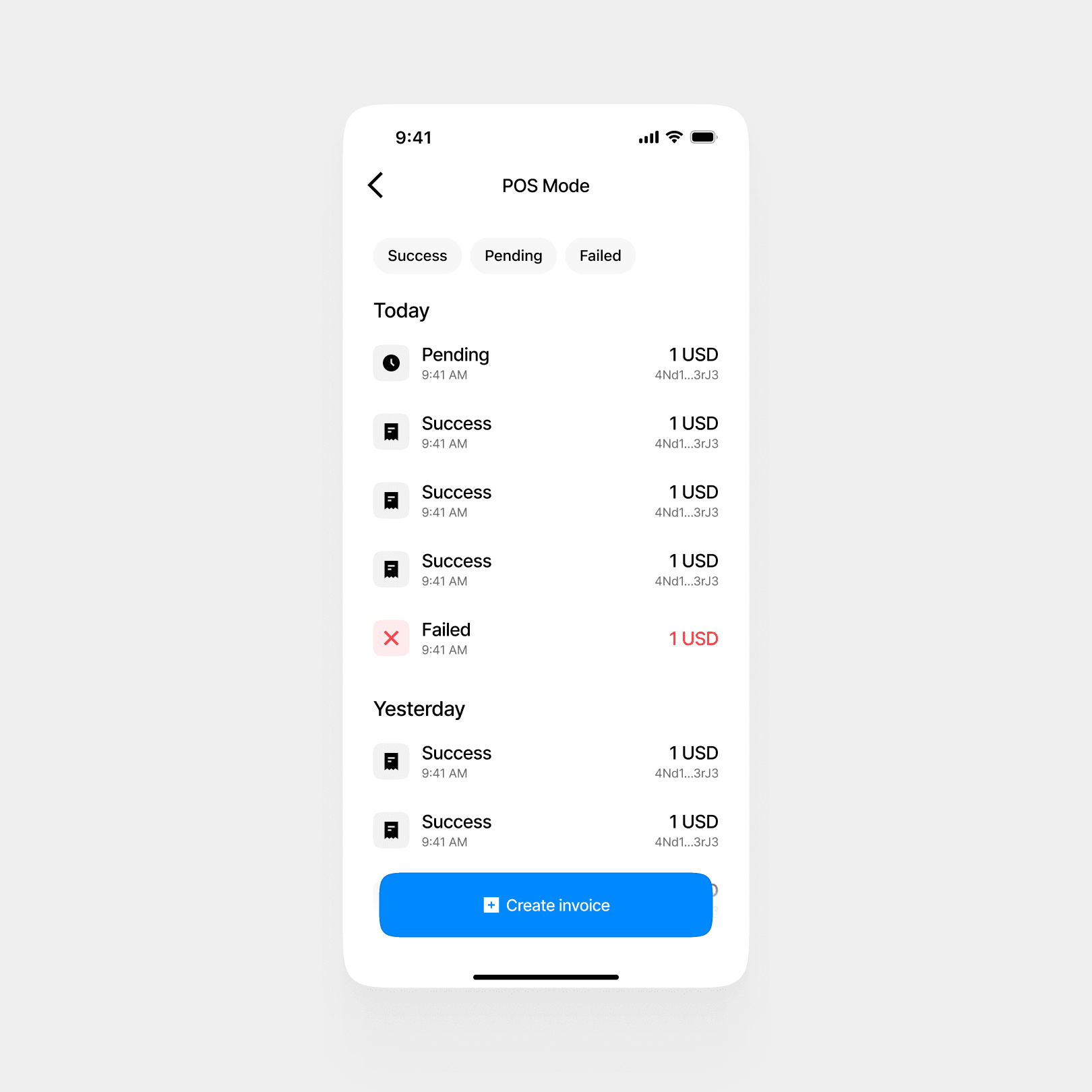

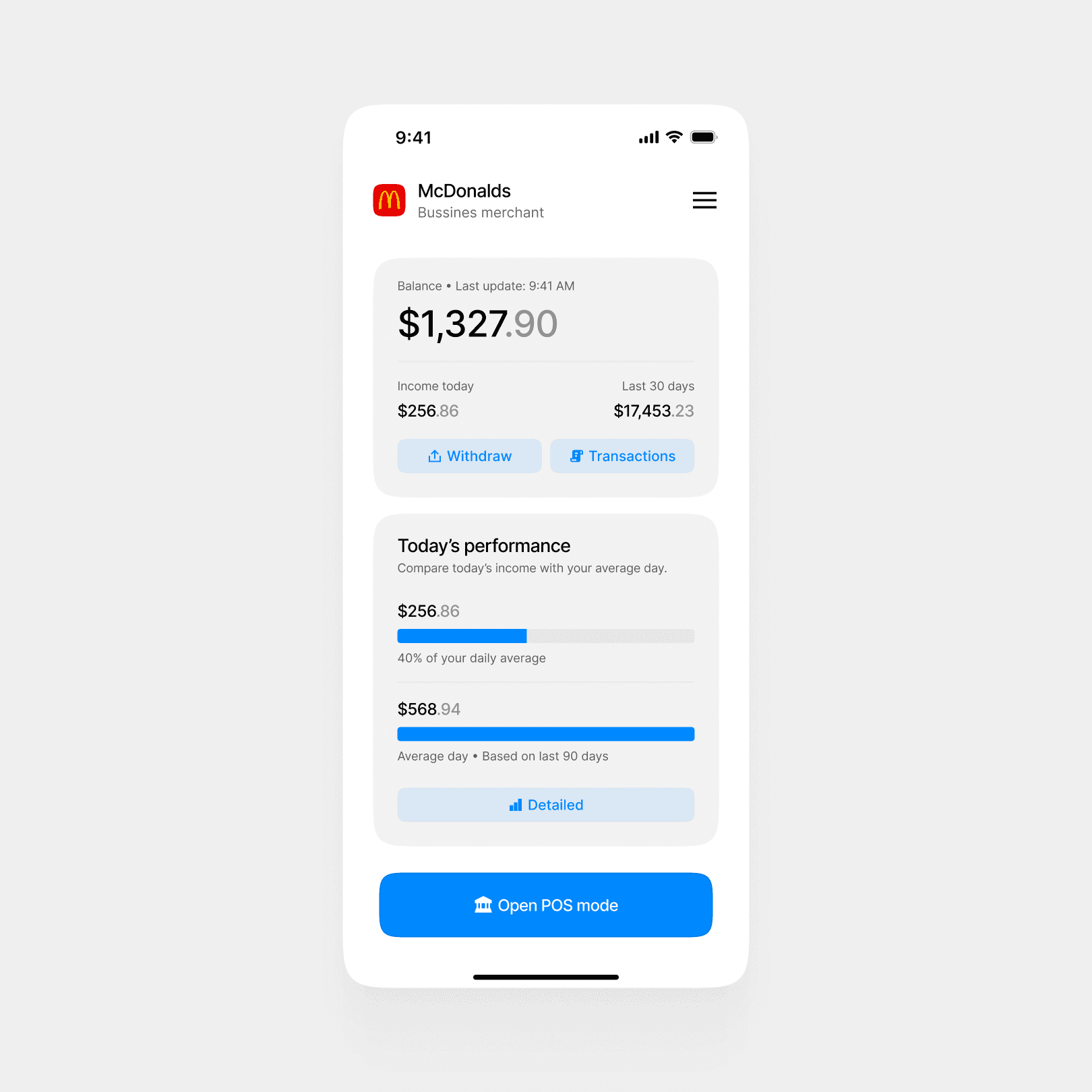

After onboarding, the merchant lands on a dashboard showing balance and recent activity. The primary action is creating an invoice and displaying a QR code to the customer.

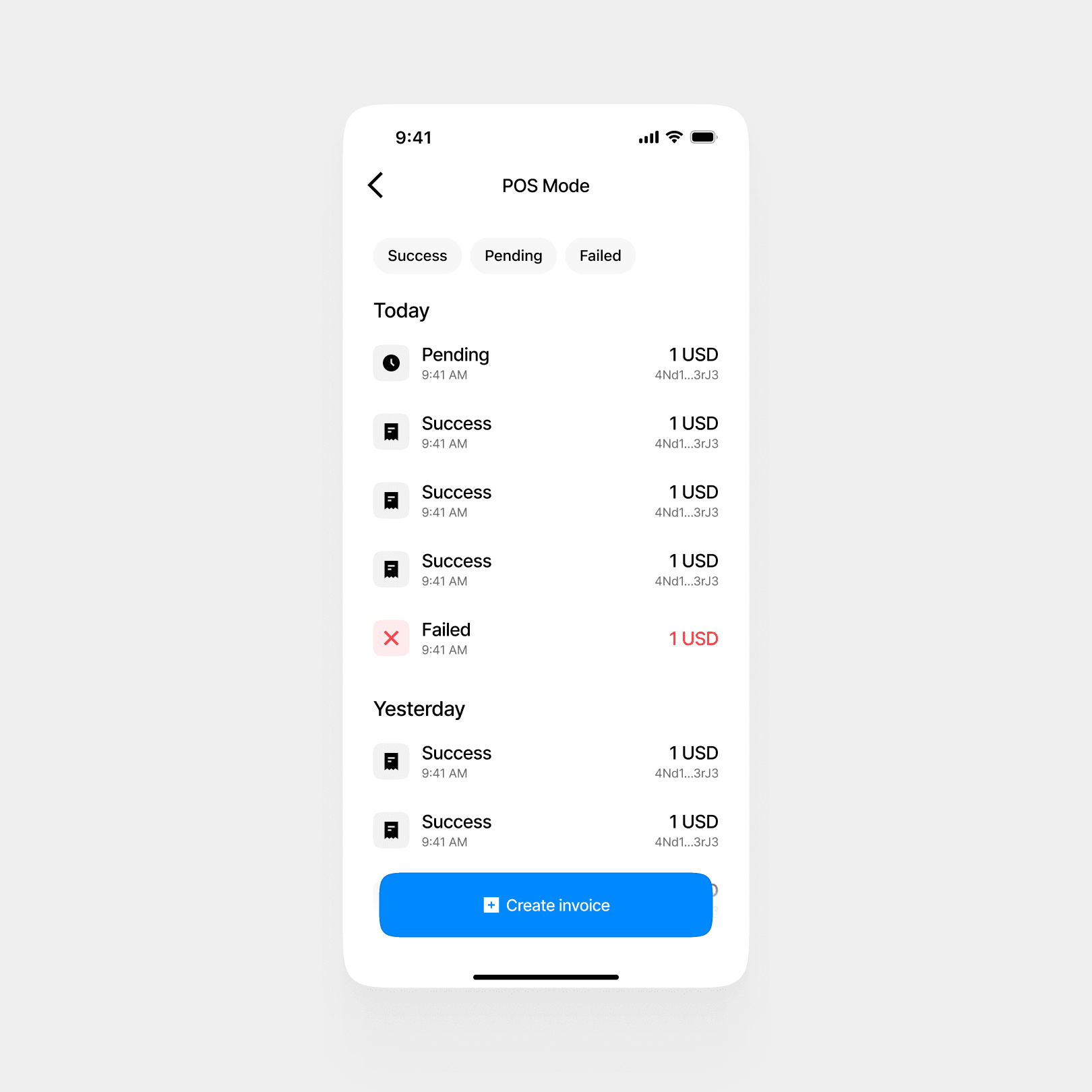

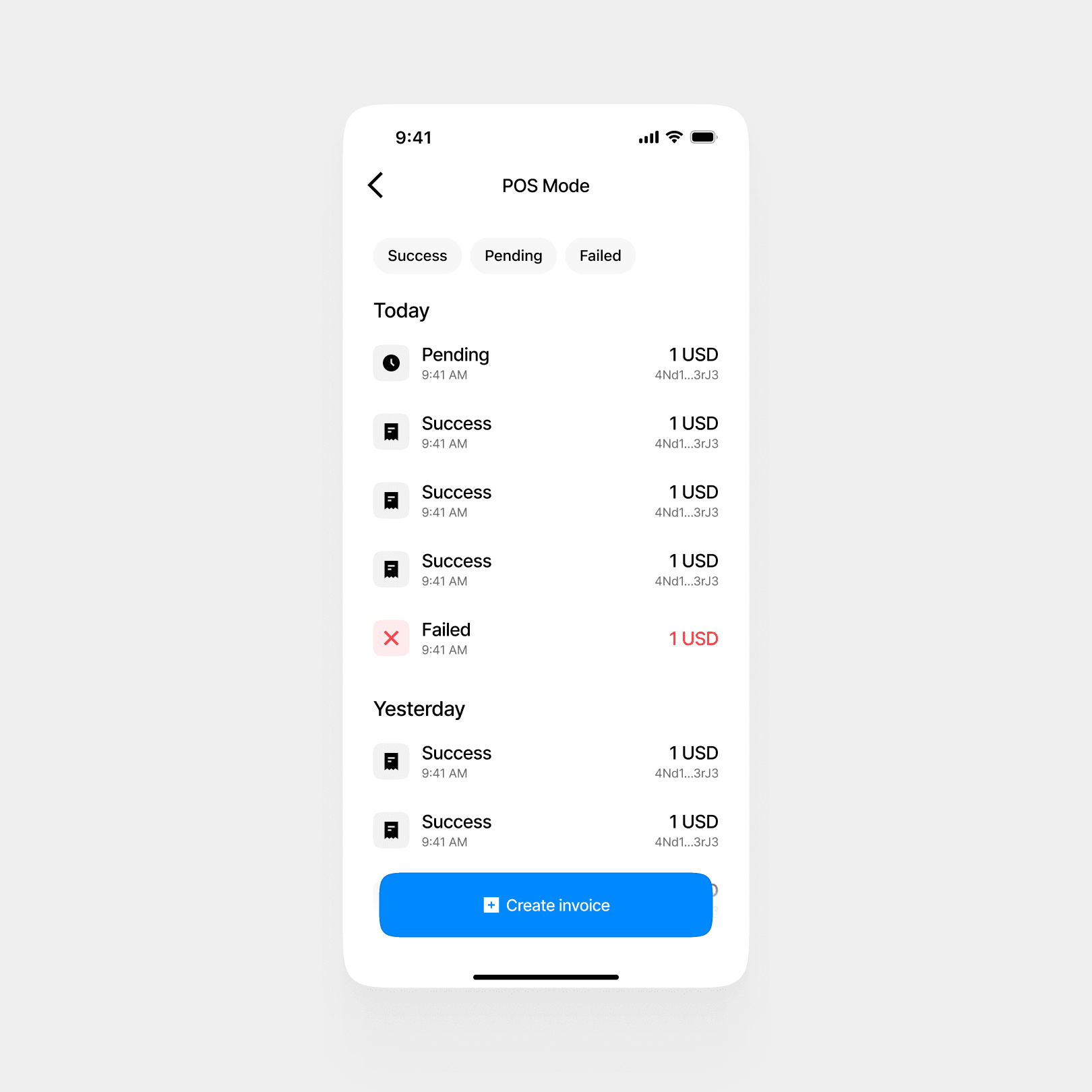

The POS mode is optimized for tablets and terminals: large typography, minimal UI, and clear payment statuses. Merchants can set a fixed amount or allow customers to enter the amount themselves.

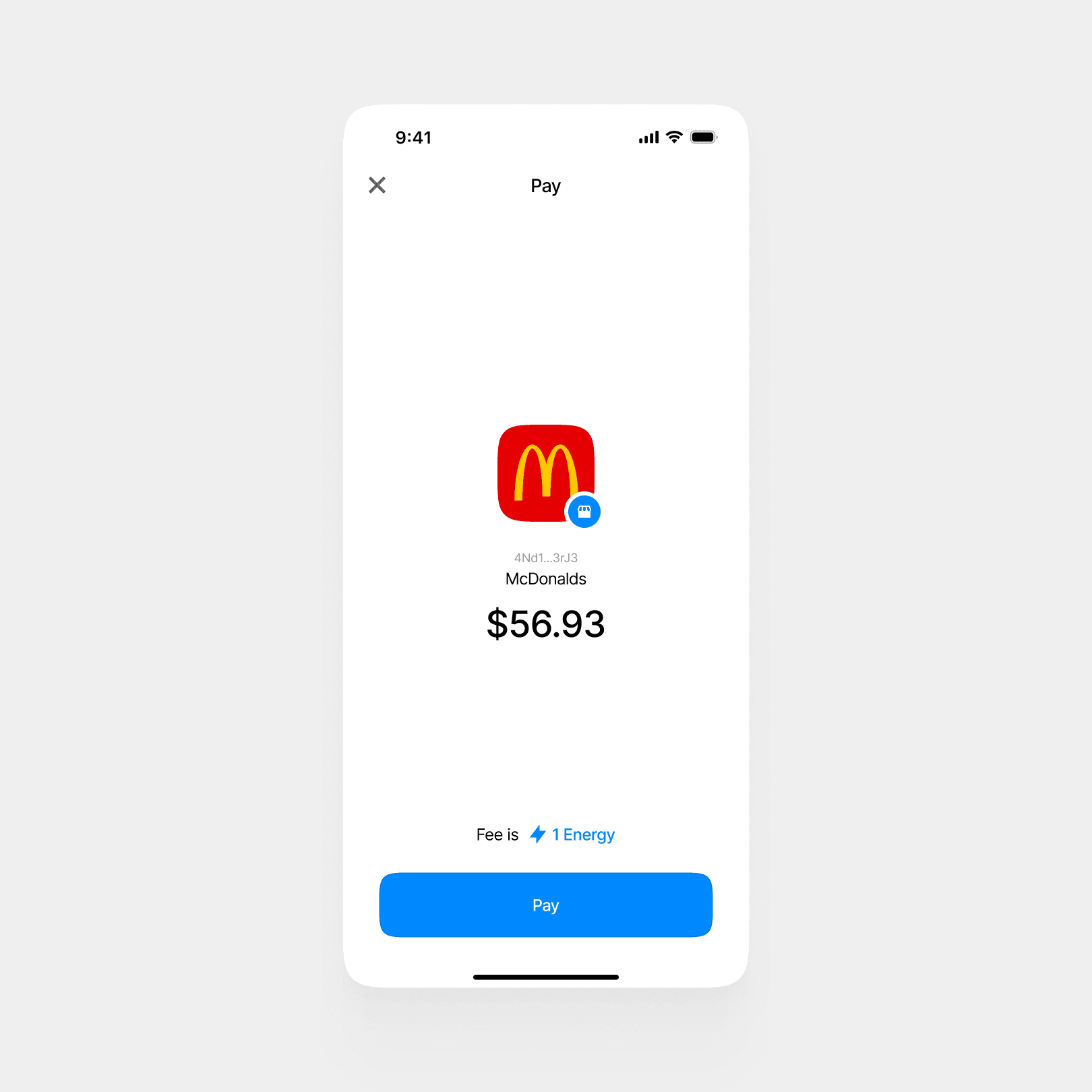

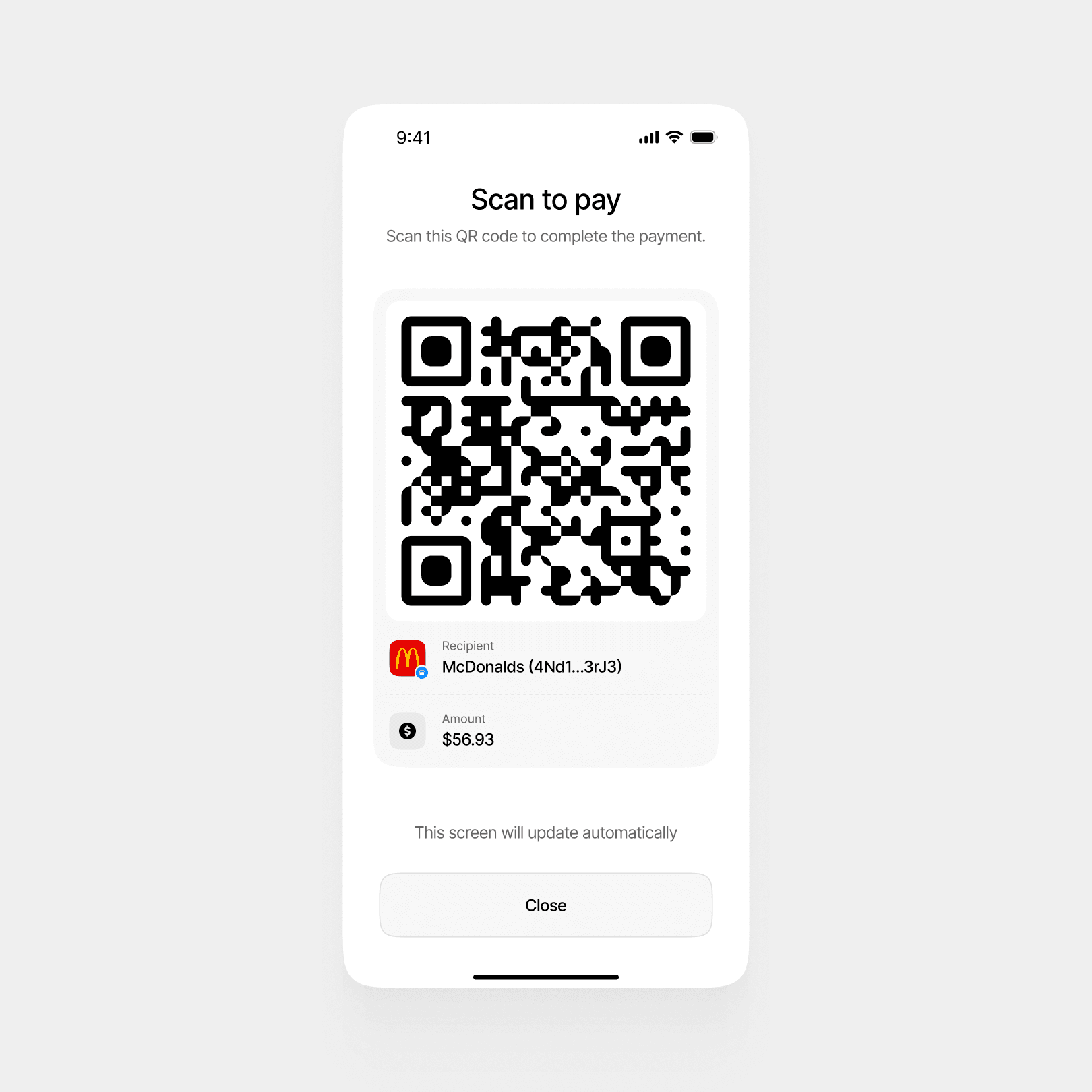

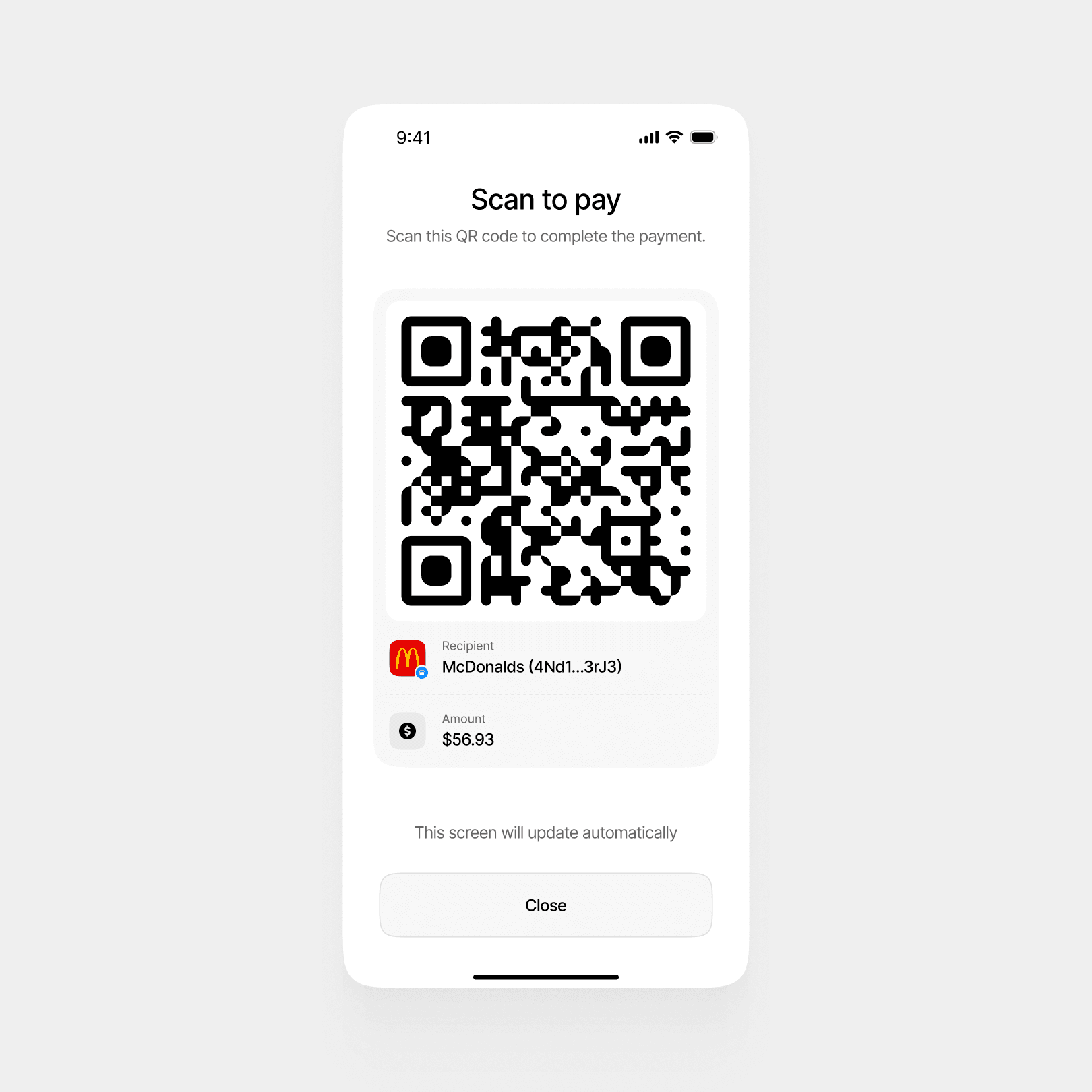

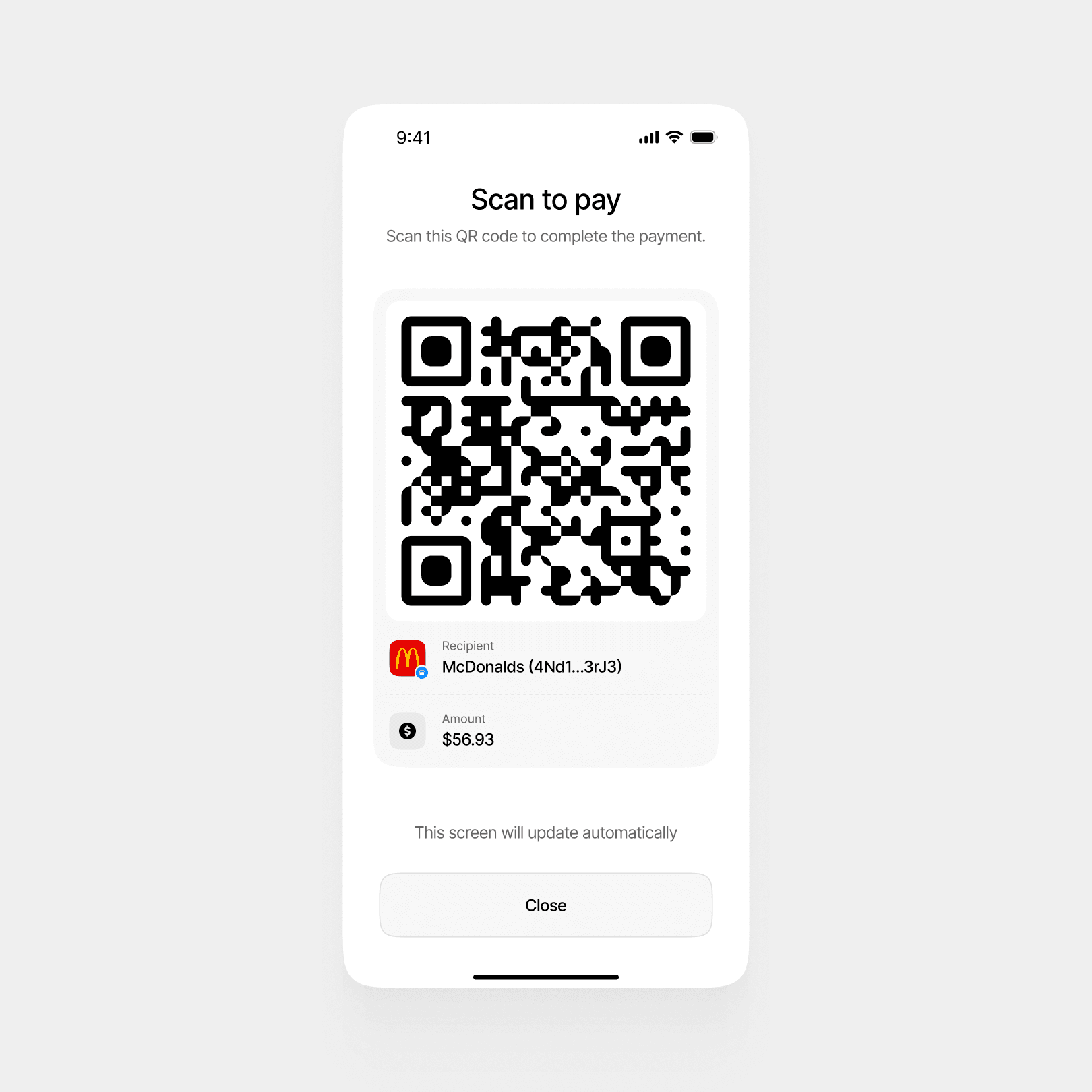

Once the customer scans the QR code, they see the business name, logo, and amount in their wallet before confirming the payment. After confirmation, the POS screen updates automatically to reflect a successful transaction.

After onboarding, the merchant lands on a dashboard showing balance and recent activity. The primary action is creating an invoice and displaying a QR code to the customer.

The POS mode is optimized for tablets and terminals: large typography, minimal UI, and clear payment statuses. Merchants can set a fixed amount or allow customers to enter the amount themselves.

Once the customer scans the QR code, they see the business name, logo, and amount in their wallet before confirming the payment. After confirmation, the POS screen updates automatically to reflect a successful transaction.

After onboarding, the merchant lands on a dashboard showing balance and recent activity. The primary action is creating an invoice and displaying a QR code to the customer.

The POS mode is optimized for tablets and terminals: large typography, minimal UI, and clear payment statuses. Merchants can set a fixed amount or allow customers to enter the amount themselves.

Once the customer scans the QR code, they see the business name, logo, and amount in their wallet before confirming the payment. After confirmation, the POS screen updates automatically to reflect a successful transaction.

Consumer trust by design

Unlike typical crypto payment solutions, Dollar Merchant was designed with consumer trust as a first-class requirement.

Each payment includes a dedicated confirmation step where users clearly see:

Business name

Logo

Amount

This flow is intentionally slower than raw blockchain transactions to prevent mistakes and reduce user anxiety.

Unlike typical crypto payment solutions, Dollar Merchant was designed with consumer trust as a first-class requirement.

Each payment includes a dedicated confirmation step where users clearly see:

Business name

Logo

Amount

This flow is intentionally slower than raw blockchain transactions to prevent mistakes and reduce user anxiety.

Unlike typical crypto payment solutions, Dollar Merchant was designed with consumer trust as a first-class requirement.

Each payment includes a dedicated confirmation step where users clearly see:

Business name

Logo

Amount

This flow is intentionally slower than raw blockchain transactions to prevent mistakes and reduce user anxiety.

Visual design

The visual language of the product follows three principles:

Minimalism

No crypto-native aesthetics

A banking-like experience without a bank

Illustrations and states use a soft, realistic 3D style without neon or web3 clichés, helping the product feel like a serious financial tool rather than an experiment.

The visual language of the product follows three principles:

Minimalism

No crypto-native aesthetics

A banking-like experience without a bank

Illustrations and states use a soft, realistic 3D style without neon or web3 clichés, helping the product feel like a serious financial tool rather than an experiment.

The visual language of the product follows three principles:

Minimalism

No crypto-native aesthetics

A banking-like experience without a bank

Illustrations and states use a soft, realistic 3D style without neon or web3 clichés, helping the product feel like a serious financial tool rather than an experiment.

Results

The result is a fully designed merchant product, ready for MVP implementation and pilot launches.

Dollar Merchant serves as:

An entry point for businesses into non-custodial payments

A distribution channel for the consumer wallet

A foundation for a scalable payment network

The case is published under an NDA name and does not disclose technical partners or implementation details.

The result is a fully designed merchant product, ready for MVP implementation and pilot launches.

Dollar Merchant serves as:

An entry point for businesses into non-custodial payments

A distribution channel for the consumer wallet

A foundation for a scalable payment network

The case is published under an NDA name and does not disclose technical partners or implementation details.

The result is a fully designed merchant product, ready for MVP implementation and pilot launches.

Dollar Merchant serves as:

An entry point for businesses into non-custodial payments

A distribution channel for the consumer wallet

A foundation for a scalable payment network

The case is published under an NDA name and does not disclose technical partners or implementation details.

THANKS FOR WATCHING

Check out for other works

Check out for other works

Check out for other works

pavel@dovnar.ru